Experts Wanted! The Pickaxe Sellers of the AI Gold Rush

The AI revolution is creating attractive opportunities for companies providing the tools and expertise needed to implement next-generation technologies

Key Highlights:

- The explosion of investor interest in AI has been one of the year's biggest themes.

- Despite the recent hype, AI is still in the early stages of development and faces ample growth runway ahead.

- The AI market is projected to expand at a compound annual growth rate (CAGR) of 42% over the next decade.

- We view some IT service providers as the "picks and shovels" companies likely to benefit from surging AI adoption.

The Year Artificial Intelligence Went Mainstream

During the California Gold Rush of the 1850s, hundreds of thousands of gold hunters traveled from around the globe after then-President James Polk publicly confirmed reports of vast deposits uncovered in the West. While some individuals made fortunes by tirelessly scouring the earth for the shiny metal, astute entrepreneurs recognized an equally lucrative opportunity in providing essential goods and supplies to gold prospectors and miners, giving rise to the phrase, "During a gold rush, sell shovels."

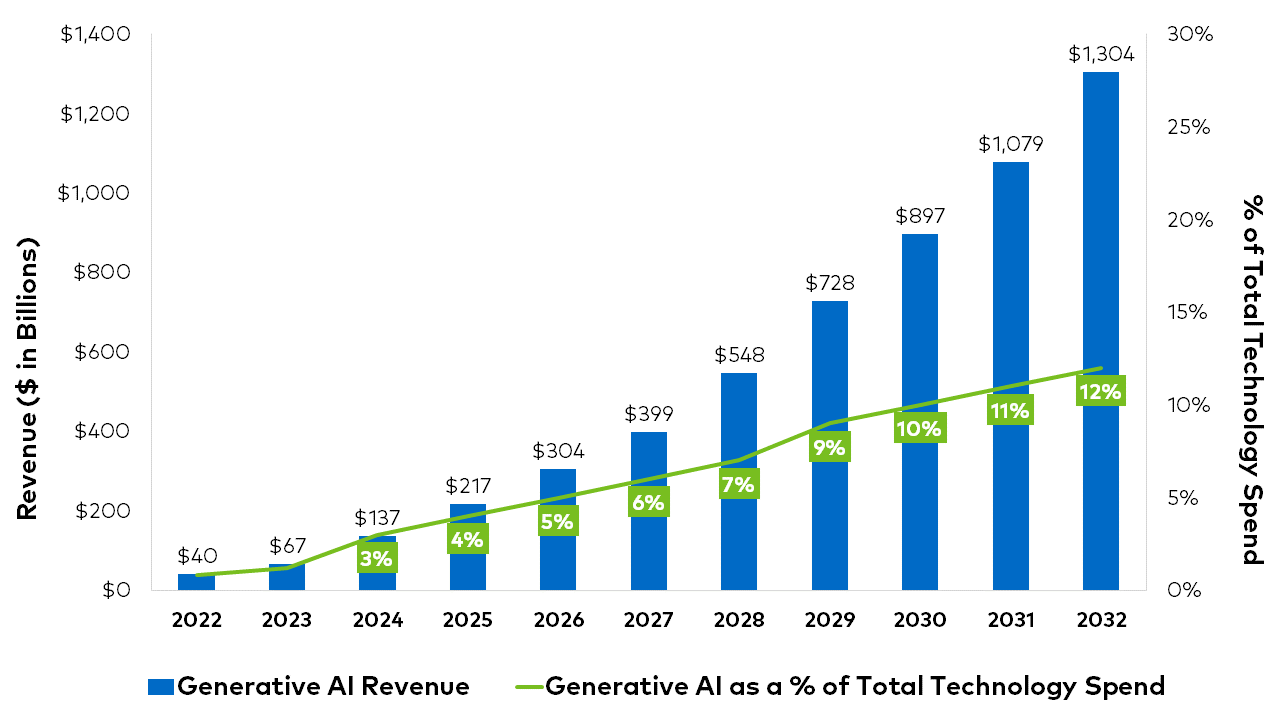

Artificial Intelligence (AI) has risen as the new gold rush for investors with billions of dollars pouring into the sector this year. Companies of all sizes, from retail and healthcare to manufacturing and transportation, are racing to implement generative AI solutions within their businesses. Yet, despite this year's wave of interest, our research indicates that the AI market is still in its early stages of development. As shown below, forecasts estimate the market to grow from $40 billion in 2022 to $1.3 trillion over the next 10 years, expanding at a compound annual growth rate (CAGR) of 42%.

Figure 1: Generative AI Revenue Forecast

Source: Bloomberg Intelligence. Forecast as of June, 2023.

Capitalizing on Technological Shifts

In our view, the explosive growth of generative AI technologies will pave the way for long-term winners and losers. Our job as investors is to look for the winners, and we believe many IT service companies will become beneficiaries of growing AI adoption. While massive technological and productivity shifts can be exciting for large enterprise companies, they can also present a daunting challenge in their scale and scope. Therefore, we believe many businesses will require outside expertise to help them navigate through these paradigm changes.

Since our inception more than 30 years ago, we've seen many similar technological breakthroughs arise, such as the transition from mainframe computers to PCs, the shift to outsourced low-cost labor, the move from licensed software to software-as-a-service (SaaS), and, most recently, the shift from on-premises data centers to the cloud. All these transformational advancements in how companies operate have typically proven a boon to well-positioned IT service firms with the expertise to help large enterprises adjust to the new reality.

Below, we will explore some key factors contributing to the rising demand for technology expertise, along with relevant examples from companies we see as beneficiaries of this trend.

1. Identification and Implementation

Generative AI technologies require a deep understanding of their underlying architecture and complex algorithms. As a result, we believe many companies lack the in-house know-how and resources to develop and execute AI models effectively. Given their highly specialized knowledge and experience, we find that technology consultants such as Accenture1 are well-positioned to benefit from the growing demand for AI specialists. Accenture helps companies throughout their AI implementation journey—from organizing data to identifying AI use cases and ensuring seamless integration with existing ecosystems.

2. Mitigating Risks and Ethical Concerns

Despite its many benefits, numerous concerns about ethics, regulatory compliance, and governance surrounding generative AI exist today. As AI technologies improve, we will likely see new risks emerge, raising demand for IT partners capable of designing well-defined AI policy frameworks based on customer security, fairness, and transparency. Infosys2, a global leader in next-generation consulting, helps companies mitigate biases in AI models, prevent data privacy risks, and develop responsible AI strategies, ensuring that AI-driven applications accentuate corporate values.

3. Optimization and Scalability

Generative AI models require significant computational resources and periodic fine-tuning for optimal results. Therefore, companies trying to do more with less are seeking the help of technology partners to optimize and scale their resources. Over the past few years, Globant3 has emerged as a market leader in providing customized technological solutions to facilitate the optimization process. They help businesses identify revenue and cost-reduction opportunities, reduce resource consumption, and uncover manual activities that could be automated. Globant also leverages AI to simplify and accelerate the analysis and quality of their assessments.

Investor Takeaways

Given AI's multidisciplinary capabilities, the demand for technology expertise is forecasted to soar. Therefore, we expect AI to be a growth catalyst for many IT companies providing critical ancillary services. Nevertheless, we believe that the companies that should benefit the most from this secular trend are those with deep transformational expertise needed to guide their customers through the complexities of implementing AI-driven solutions.

As investors, distinguishing AI companies at the forefront of innovation from those simply repurposing older tech is vital. In our view, providers of "picks and shovels," such as Accenture, Infosys, and Globant, stand to play decisive roles in shaping the future of enterprise AI. At Polen Capital, our investment teams follow AI's evolution closely, seeking to invest in competitively advantaged companies we believe are well-positioned to thrive in a rapidly changing world.

Important Disclosures

1. Accenture is a holding in Polen’s Focus Growth portfolio as of June 30, 2023.

2. Infosys is a holding in Polen’s Emerging Markets Growth portfolio as of June 30, 2023.

3. Globant is a holding in Polen’s Global Growth and Global SMID Company Growth portfolios as of June 30, 2023.

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of September 2023 may involve a number of assumptions and estimates which are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This document is provided on a confidential basis for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital.