Public vs. Private Credit: Different Sides of the Same Die

The private credit market has been in the limelight in recent years, but we believe current price discounts to par offer a compelling case for investing in public credit markets.

Key Highlights

- Private credit has emerged as an attractive alternative to traditional bank lending for companies, becoming one of the fastest growing segments of finance.

- Despite the rise of private credit, we believe that the discount to par offered in more liquid markets, such as high yield bonds and broadly syndicated loans, presents a compelling opportunity that some investors may be overlooking.

- At Polen Capital, our flexible mandates are designed to capitalize on structural market inefficiencies, such as changing risk-reward dynamics across high yield bonds, broadly syndicated loans, and private credit.

The Private Credit Boom

In recent years, the private credit market has swiftly evolved from a once niche corner of the lending landscape to a vital source of capital for all kinds of businesses, tripling in size since 2015. Though private credit—broadly defined as non-rated loans originated by institutions other than banks—has been around since the 1980s, the asset class surged in popularity following the Great Financial Crisis of 2007-09 as an alternative to public debt, particularly for smaller businesses unable to secure funding through the issuance of more liquid assets such as corporate bonds and leveraged loans.1

Amid tighter lending standards and higher capital requirements imposed by regulators on deposit-taking institutions, companies seeking to borrow money have been increasingly bypassing mainstream financing channels and working directly with private lenders, who have filled the financing gaps left by traditional banks. Over the past year, we have seen credit deals migrate away from banks facing liquidity pressures and move to private lenders with large pools of capital.

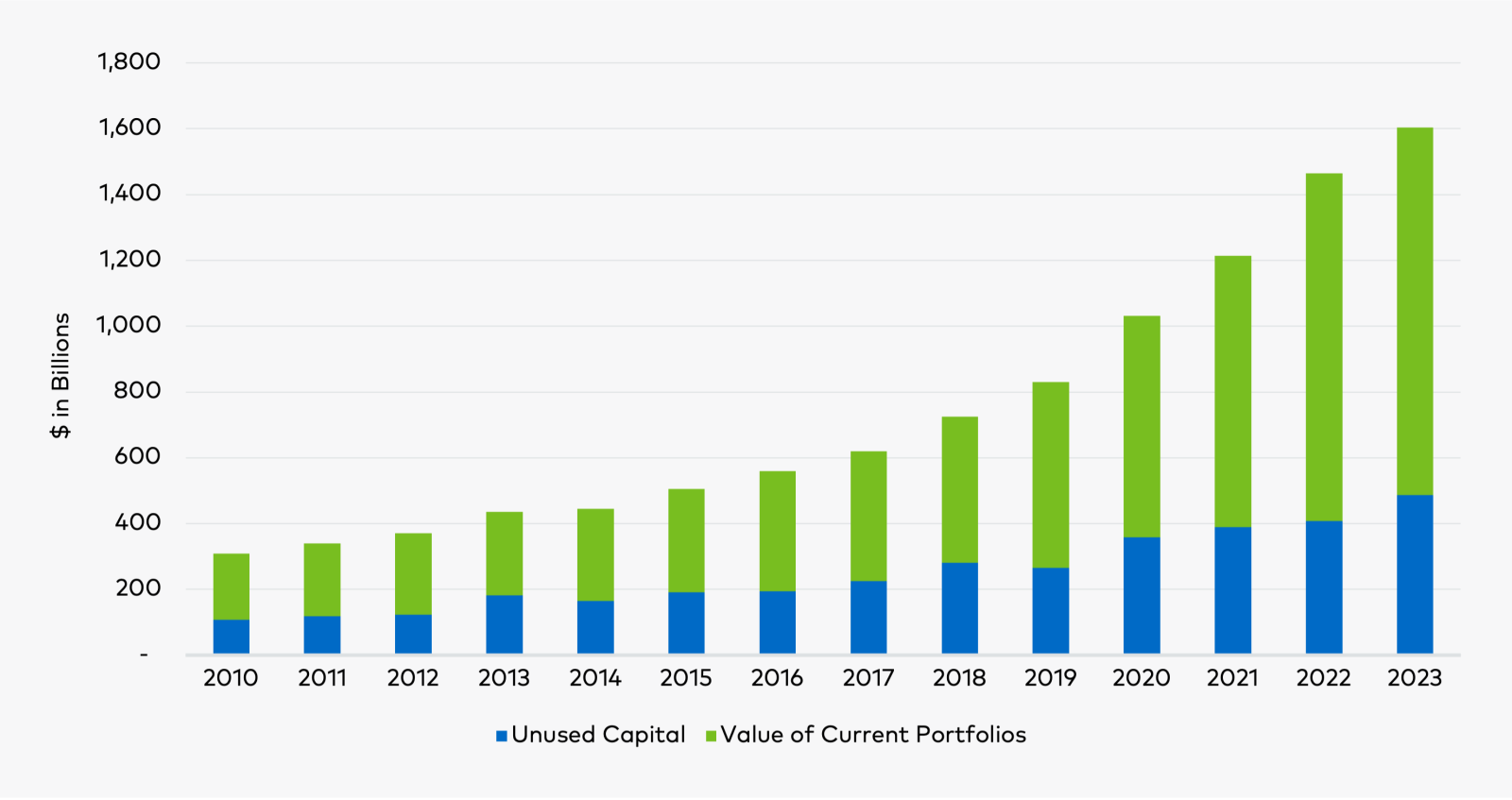

As seen in Figure 1, global assets under management in private credit funds soared from approximately $500 billion in 2015 to approximately $1.6 trillion this year through March, including nearly $500 billion in “dry powder” waiting to be deployed, according to data provider Preqin. To put this into context, Bloomberg estimates that the available resources of private credit funds today are often on par with those of large banking syndicates (Hidalgo, 2023).

Figure 1: Global Private Debt Funds Assets Under Management

Source: Preqin. Data to March 2023.

Putting the Cost of Illiquidity into Perspective

In our view, the current state of the broader credit market is a byproduct of the need by lenders to deploy large pools of uninvested capital and a general decline in new debt creation in part due to the rise in interest rates since the end of 2021 coupled with a decrease in merger and acquisition activity. In an environment where interest rates are forecasted to stay “higher for longer,” private credit lenders have focused on competing with and outbidding liquid debt markets.

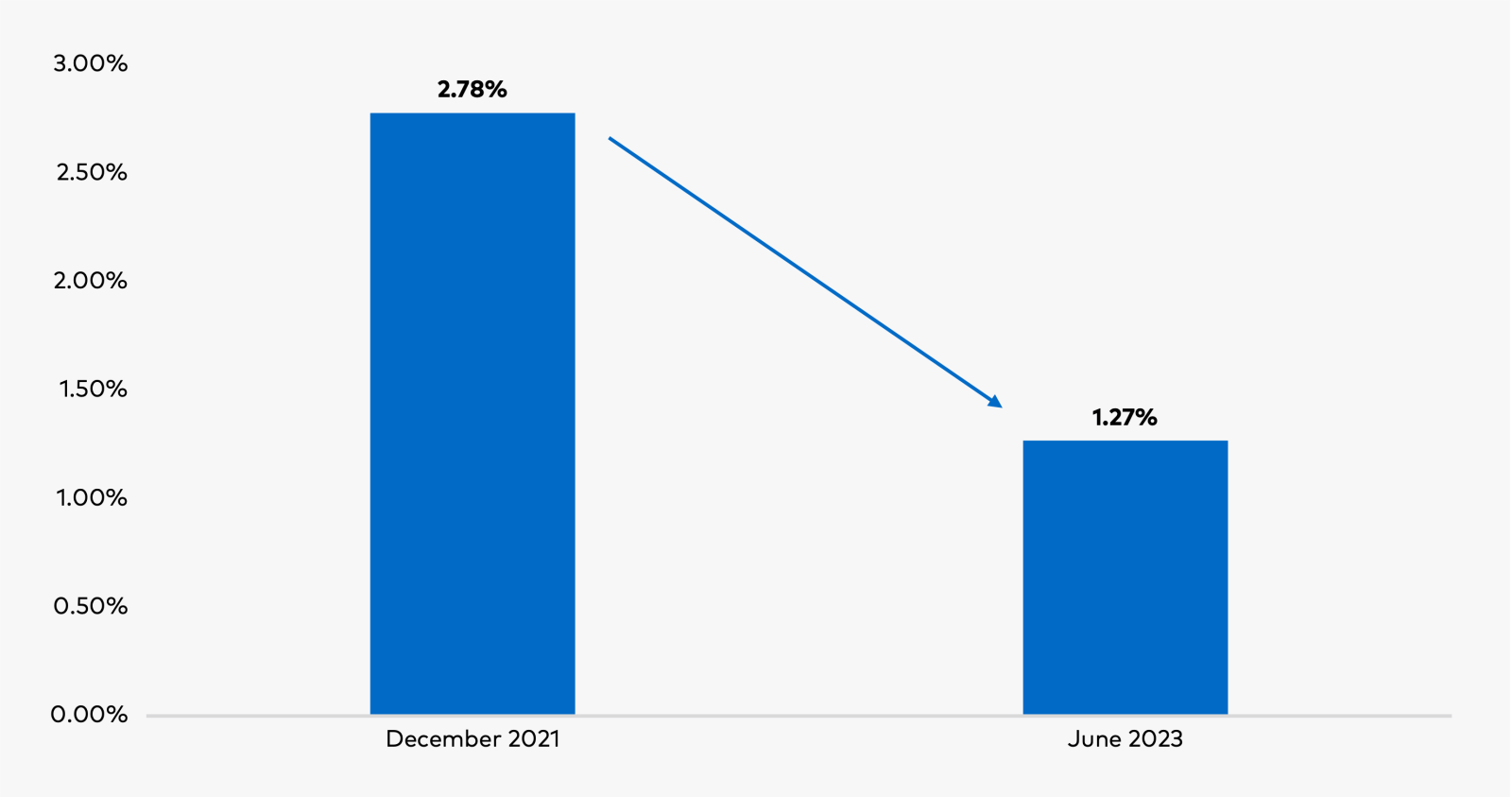

Yet, while private lenders have benefited from a higher interest rate environment because their loans feature a floating rate, the premium associated with investing in less liquid private debt has nonetheless contracted over the past year. According to data from Cliffwater, the liquidity premium—defined as the yield pickup for investing in private credit relative to broadly syndicated loans—declined for Directly Originated Upper Middle Market loans from 2.78% as of the end of 2021 to 1.27% on June 30, 2023, as seen in Figure 2.

Figure 2: Liquidity Premium

Source: Cliffwater, as of June 2023.

Revisiting the Case for High Yield Bonds and Leveraged Loans

Since the end of 2021, more liquid credit instruments, such as high yield bonds and broadly syndicated loans, have traded off amid a change in market conditions. Given today’s valuation discounts, we find some liquid leveraged credit markets relatively more attractive. For investors, the price discount of high yield bonds relative to par means they may find compelling entry points in the current environment. For example, we often can buy high yield bonds at a significant discount to par2 as the average price in that market is in the high 80s.3 Similarly, the average price in the leveraged loan market is in the mid-90s.4

Given the current pricing levels in more liquid markets, it may not make sense for investors looking to allocate assets to purchase private loans at par when they can instead buy liquid bonds and leveraged loans at a discount, which could potentially enhance total returns while at the same time providing improved liquidity. Moreover, while much attention has been centered on private credit, we believe that the present backdrop of low default rates, a higher-quality investable universe, and the reduced probability of a severe economic recession further support the case for high yield bonds and leveraged loans.

Investor Takeaways

At Polen Capital, our credit strategies, which primarily invest in high yield bonds and broadly syndicated loans, seek to find attractive middle-market issuers often overlooked by other managers. In addition to high yield bonds and broadly syndicated loans, we target less-liquid investments, such as club deals and private credit (primarily direct lending opportunities). Our investment philosophy remains focused on exploiting structural inefficiencies in the market, which have persisted since we began investing in leveraged credit markets over 25 years ago.

One of the structural inefficiencies we aim to capitalize on is the changing risk-reward dynamics across high yield bonds, broadly syndicated loans, and private credit. From our perspective, private credit is part of the broader leveraged credit asset class. Hence, we view it as a single component of a broader investment strategy focused on below-investment-grade credit. Although we consider each of these components a different side of the same die, the risk-reward can shift over time, including each component’s associated liquidity risk.

A completely illiquid allocation to a private credit strategy may make sense for some investors. However, we currently see compelling alternatives for investors who do not have a high risk tolerance for illiquid assets. Therefore, as risk-reward shifts over time, we believe that allocating capital to one of Polen’s credit strategies could potentially provide investors with a cost-effective solution to capture relative value opportunities across both liquid and illiquid debt markets.

Important Disclosures

1In an effort to strengthen the financial system in the aftermath of the Great Financial Crisis of 2007-09, regulators significantly raised the minimum size of public debt market issuances, making it more difficult for smaller companies to tap into public markets.

2A bond described as “trading at 100” means it costs $1,000 for every $1,000 of face value and is said to be trading at par. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. A bond is priced at a discount below par value when the coupon rate is less than the market discount rate.

3As of December 1, 2023. Using the average price of the ICE BofA U.S. High Yield Index.

4As of December 1, 2023. Using the average price of the Credit Suisse Leveraged Loan Index.

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of December 2023 and may involve a number of assumptions and estimates which are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions.

The views and strategies described may not be suitable for all clients. This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice.

Definitions

The Global Financial Crisis was a severe worldwide economic crisis. The National Bureau of Economic Research dates the recession around this crisis from December 2007 through June 2009.

References

Hidalgo, K. (2023, October 27). How Private Credit Gives Banks a Run for Their Money. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2023-10-27/what-is-private-credit-and-how-does-it-work

Past performance does not guarantee future results and profitable results cannot be guaranteed.