Beyond Fundamentals: Outlook on Digital Payments

Dan Davidowitz discusses the dominance of Visa & MasterCard. Can this duopoly be disrupted?

Dan Davidowitz, portfolio manager and analyst for Polen’s Focus Growth strategy, shares his insights on the often-misunderstood world of digital payments.

What interests you the most about the digital payments space from an investment perspective?

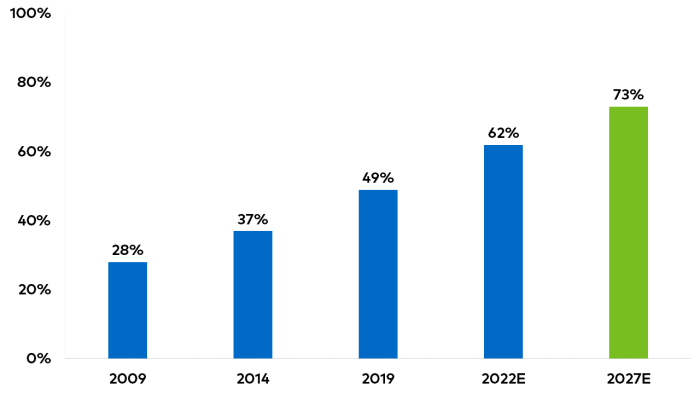

There's a lot to like about digital payments. First, it's an area of secular growth. People are using digital payments more and more every year. Not long ago, most U.S. transactions were in cash and check. Now, the majority use digital forms of payment and outside the U.S., there's even more room to grow.

Exhibit 1: Card Penetration of Purchase Personal Consumer Expenditure (PCE)

Source: Nilson, World Bank, IMF and Bernstein estimates and analysis.

Secondly, it's exceedingly hard to process digital payments quickly, accurately, and with minimal fraud or downtime. Very few companies can do it on a global scale like Visa and MasterCard, so it's difficult to compete with them.

What else stands out to you about Visa and MasterCard?

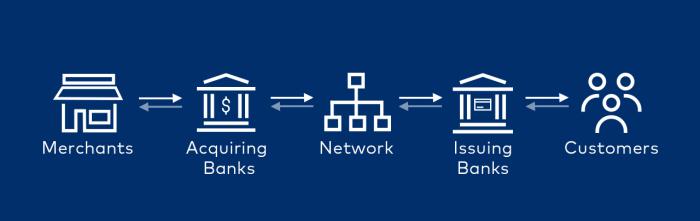

These two companies sit at the nexus of consumers, merchants, and banks. They enable a whole payments ecosystem that wouldn't be able to function without them, as they link to all counterparties and confirm that transactions between them can happen. And they make these approvals happen anywhere on the planet within milliseconds, billions of times per day. So, they've become trusted partners that can operate cost-effectively because of their scale.

Exhibit 2: The Payments Value Chain

Source: Polen Capital.

One nuance that investors don't always understand is that the credit risk these companies assume is minimal. They take credit risk for only the fractions of seconds that it takes to confirm the validity of the transactions.

Over time, we've heard about many potential disruption risks for Visa and MasterCard. Years ago, some predicted that retailers would organize their own payment networks. Later, there were presumptive threats from other networks and digital wallets like Apple Pay. More recently, the focus has been on whether cryptocurrency might displace the incumbents. However, none of these threats seem to have changed the business model for these companies. Why is that?

We've observed that each time one of these new, disruptive players comes along, they eventually partner with Visa and MasterCard. And again, this is because no one has figured out how to transact as cheaply, reliably, or globally.

Why do new entrants struggle to replicate the model?

With their massive volume of transactions, Visa and MasterCard have access to a tremendous amount of information. Due to their longevity, they've also overcome three huge hurdles of acceptance—from consumers, banks, and merchants—that are difficult for newcomers to surpass.

You've studied many other high-quality businesses in this space. How do their models compare?

That's a tricky question because we only focus on analyzing companies that we believe are outstanding and competitively advantaged. That said, it's tough to find a duopoly of this caliber, with robust secular growth trends behind it and such a critical position within the global economy. Visa and MasterCard enjoy pricing power and have a history of making strategic capital allocation decisions. In our team's view, these factors make their businesses extremely hard to disrupt.

Important Disclosures

Visa and MasterCard are holdings in Polen Capital’s Focus Growth and Global Growth portfolios as of March 31, 2023.

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of May 2023 and may involve a number of assumptions and estimates which are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This document is provided for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital Management.

Portfolio information is shown as of March 31, 2023 and should not be construed as a recommendation to purchase, hold or sell any particular security. There is no assurance that any securities discussed herein will remain in the composite or that the securities sold will not be repurchased. The securities discussed do not represent the composite's entire portfolio. Actual holdings will vary depending on the size of the account, cash flows, and restrictions. It should not be assumed that any of the securities, transactions or holdings discussed will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. A complete list of our past specific recommendations for the last year is available upon request.

Past performance does not guarantee future results and profitable results cannot be guaranteed.