Small Caps: Resilience & Agility Amid Uncertainty

We believe high-quality small caps have what it takes to emerge even stronger from a challenging environment

Summary Highlights

- Not all small caps are the same; high-quality businesses often display resilience and agility in the face of uncertainty.

- Companies that are nimble and not reliant on external funding can play offense during good and bad times, in contrast with their debt-heavy peers.

- Talented, disciplined management teams and deep, loyal customer relationships are two examples of attributes we seek as investors.

- According to our research, small caps—both in and outside the U.S.—are one of the world’s most thinly covered asset classes, leading to inefficiencies that can create opportunities for discerning managers.

The Silicon Valley Bank Fallout

In mid-March, the collapse of Silicon Valley Bank and other U.S. regional banks spurred a wave of volatility across financial markets, raising concerns about bank runs and contagion. While the U.S. government’s rapid intervention to guarantee deposits helped inject confidence into the banking system, the spillover effects still linger over the broader economy. In the aftermath of the fallout, banks have turned more cautious and enacted tighter lending standards, making it increasingly difficult for businesses to borrow.

Times like these underscore why our Small Cap Growth team avoids investing in banks. In recent years, some quality growth managers perceived lower-quality industries as a safe place to “hide,” given their relative outperformance. Over time, however, these industries have shown themselves highly susceptible to demand destruction. As a result, we believe many companies in these industries will struggle in the face of tighter credit availability and a recessionary environment.

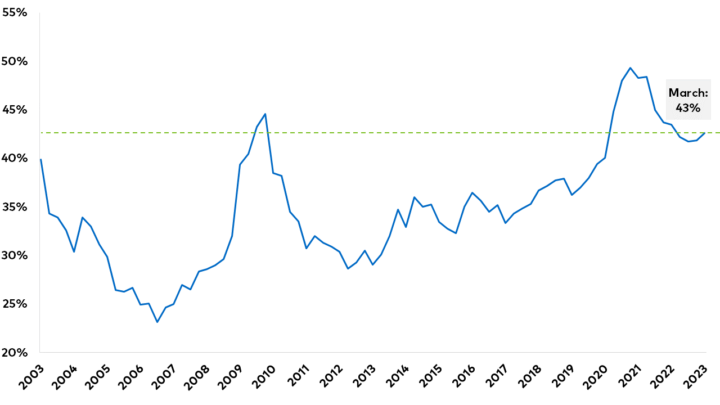

A commonly held belief among investors is that small caps tend to underperform in periods of economic stress, prompting investors to gravitate away from the segment as macro uncertainty rises. After all, more than 40% of the companies in the Russell 2000 index are unprofitable, as seen below. However, painting every small cap company with the same broad-brush risks overlooking compelling, high-quality investment opportunities in the small cap universe.

Percent of Unprofitable Companies in the Russell 2000 Index:

Source: Bloomberg. As of March 31, 2023.

High-Quality Outliers

Though we agree that certain companies—primarily those with unprofitable business models, high debt levels, and low returns on investment—could be more susceptible to external pressures during tough times, high-quality small-caps often display resilience and agility in the face of uncertainty. With the era of low-interest rates and abundant liquidity over, we believe higher borrowing costs and stricter credit requirements are likely to pose substantial challenges for debt-laden and cashflow-negative companies.

The current backdrop underscores why we invest the way we do, owning only the highest quality growth businesses that do not rely on external capital to grow. Contrary to their low-quality counterparts, we expect high-quality companies to be “masters of their own destinies.” Nimble and agile, high-quality small businesses that do not rely on external funding can play offense by leveraging their competitive advantages to gain market share during difficult periods while lower-quality competitors may have to retrench.

A key competitive advantage that can go under-appreciated in good times is a talented, long-term-oriented management team capable of exercising discipline and making quick company-wide decisions. Founder-led companies, where the founder remains in a position of influence—such as CEO, chairperson, or board member—often showcase this essential blend of operational nimbleness and entrepreneurial culture. Since founders typically have much of their wealth invested in the business, it stands to reason that, more than not, founder-led organizations prioritize long-term fiscal responsibility and strategic thinking and are better aligned with the interests of minority shareholders.

In our view, Goosehead Insurance, a personal property and casualty insurance agency primarily focused on home and auto markets, exemplifies some of the strengths of founder-led companies. Robyn and Mark Jones are the co-founders of Goosehead Insurance, where Mark is chairman and CEO, and Robyn is vice chairman. Goosehead was founded on the premise that the consumer should be at the center of the company’s universe and that all actions should be directed at providing extraordinary service. Despite weakness in the housing market, the business has showcased resiliency, leaning into its value propositions around excellent customer service and a better agent experience and kicking off thoughtful, value-add strategic growth programs.

Another way high-quality small companies have turned their size into an advantage is by building deep and loyal customer relationships. Though large companies often have more market share, they typically cast a wide net and employ a “one-size-fits-all” approach to servicing their clients. Yet, many customers partner with smaller companies because they seek a more customized offering and feel closer to senior management or critical decision-makers. Furthermore, being small enables organizations to target niche markets that larger companies overlook, given their focus on pursuing high-volume markets.

Small Caps: Overlooked Opportunities

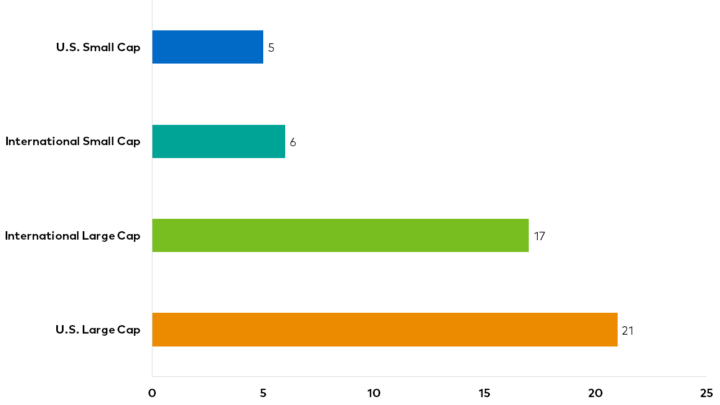

Despite the compelling opportunity set in small caps, few analysts are covering companies at this end of the market cap spectrum, as shown below. According to our research, small caps—inside and outside the U.S.—are among the most thinly covered asset classes, leading to inefficiencies that create opportunities for discerning managers to find outliers. Furthermore, we believe that due to fewer analysts focusing on smaller companies, their valuations are less likely to reflect their intrinsic value, creating a window of opportunity for active investors to take advantage of.

Average Coverage By Asset Class:

Source: Polen Capital and FactSet. As of December 31, 2022. Median analyst coverage by asset class. Analyst estimates are from FactSet consensus and are subject to change over time. "U.S. Large Cap" is represented by the S&P 500 index; "International Large Cap" is represented by the MSCI AC World ex-USA Large Cap" index; "U.S. Small Cap" is represented by the Russell 2000 index; "International Small Cap" is represented by the MSCI AC World ex-USA Small Cap" index.

The Polen Capital Approach

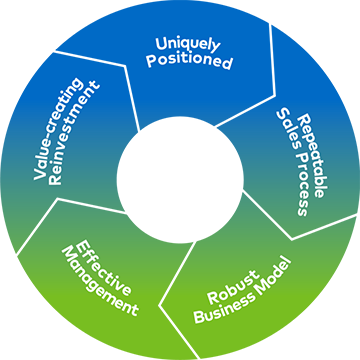

While all of today’s most successful large companies once began their lives as small businesses, it is important to highlight that not all small caps are created the same. Within the small cap universe, there is a high degree of variability in growth and quality. This is one of the reasons we analyze opportunities through our Flywheel Framework—our assessment of quality around a set of five self-reinforcing conditions that increase the odds of long-term compounding.

Having any of these conditions creates a high bar. Yet, we demand that all five be in place to consider investing in a company. This discipline allows us to cut through the noise and confidently deploy capital for the long term.

When it comes to business resiliency, bigger does not always mean better. The best small-cap growth companies can play defense by quickly right-sizing cost structures and becoming profitable if needed, given their high starting levels of investment. In addition, they can play offense and take advantage of adjacencies or even opportunistic potential value-added acquisitions.

Of course, many companies do not meet this high hurdle, which is why we hold a concentrated portfolio of companies that do not just have the potential to offer growth and high returns, but also durability, robust business models, the ability to self-fund growth, and what we believe to be superior management teams.

Important Disclosures

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of April 2023 may involve a number of assumptions and estimates which are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This document is provided on a confidential basis for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital Management.

The information provided in this document should not be construed as a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will be in the composite at the time you receive this document or that any securities sold have not been repurchased. The securities discussed do not necessarily represent the composite's entire portfolio. Actual holdings will vary depending on the size of the account, cash flows, restrictions, and any trade orders in progress on the date as of when holdings are shown. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable or that any investment recommendations we make in the future will equal the investment performance of the securities discussed herein. For a complete list of Polen'spast specific recommendations holdings and current holdings as of the current quarter end, please contact [email protected].

The S&P 500® Index is a market capitalization weighted index that measures 500 common equities that are generally representative of the U.S. stock market. The index is maintained by S&P Dow Jones Indices.

The MSCI ACWI ex USA Index is a market capitalization weighted equity index that measures the performance of large and mid-cap segments across developed and emerging market countries (excluding the U.S). The index is maintained by Morgan Stanley Capital International.

The MSCI ACWI ex USA Small Cap Index is a market capitalization weighted equity index that measures the performance of the small-cap segment across developed and emerging markets (excluding the U.S). The index is maintained by Morgan Stanley Capital International.

The Russell 2000® Index is a market capitalization weighted index that measures the performance of the small-cap segment of the U.S. equity universe. It is compd of 2,000 of the smallest securities in the Russell 3000® Index. The index is maintained by the FTSE Russell, a subsidiary of the London Stock Exchange Group.

Past performance does not guarantee future results and profitable results cannot be guaranteed.