AI’s Second Act: From Suppliers to “Appliers”

Why value is shifting from AI infrastructure to the businesses that integrate and monetize it.

ChatGPT has only been on the scene since 2022. Since then, the world has raced to build the “picks and shovels”—the chips, power, and data‑center infrastructure that make AI possible. Now the story is shifting: the appliers who weave AI into products and workflows appear positioned to define the next decade.

Since launch, the AI narrative has largely revolved around the companies enabling the build‑out of infrastructure—semiconductors, electrical equipment, power generation, and data‑center construction. We believe the opportunity in these suppliers will continue.

But history shows that the baton eventually passes from the suppliers to the appliers—businesses that embed new technology into products, processes, and, in some cases, entirely new categories. The late 1990s internet cycle offers a useful framing: early value accumulated to the companies laying the foundation (fiber optics, networking gear, servers), where demand was driven by capex cycles rather than true end‑market adoption. Over time, however, the biggest winners were those that integrated the internet into their models to scale, serve customers better, and pioneer new business models. Many of today’s mega‑caps—including Amazon and Google—emerged from that transition.

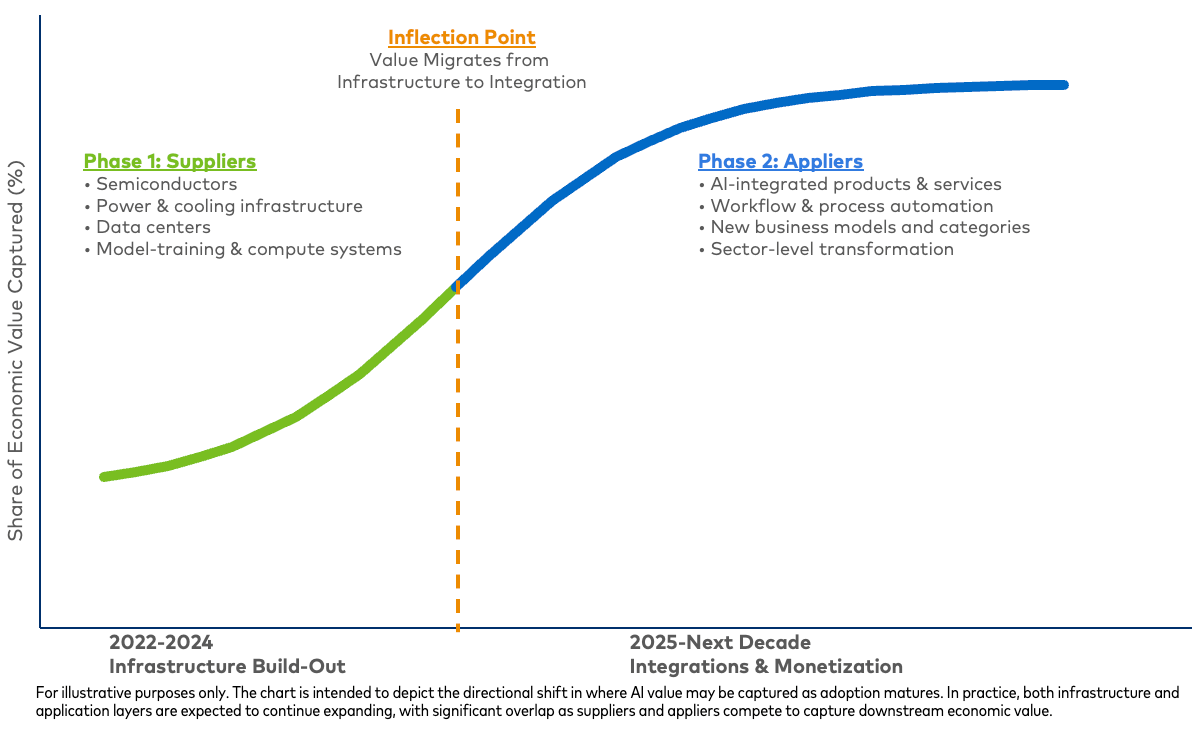

We believe a similar dynamic is unfolding with AI. Infrastructure remains essential, but value creation is increasingly shifting from the “picks and shovels” providers to the appliers—businesses that integrate and monetize AI within their products. To illustrate this shift, Figure 1 provides a conceptual view of how we see value migrating from suppliers to appliers across the AI ecosystem.

Figure 1: Shifting Value Capture in the AI Ecosystem: From Suppliers -> Appliers

Health Care

We think Health Care is among the sectors most ready for AI-driven change. Health Care faces high administrative costs, clinician burnout and shortages, fragmented data, and inconsistent patient experiences. AI can lower administrative burdens for busy clinicians and improve triage decisions by helping identify which patients need higher-acuity care sooner.

Beyond services, AI is also reshaping biotech and pharma. Drug discovery and R&D have historically been slow and expensive. AI can accelerate early-stage screening by rapidly evaluating potential compounds and modeling interactions before lab testing. In clinical trials, AI can help identify eligible patients faster and support real-time monitoring, potentially shortening timelines and improving productivity.

Consumer

For consumers, the key is to distinguish surface-level AI features from genuine integration into the customer experience. Companies with strong first-party data can leverage AI to personalize discovery and recommendations, boost loyalty, and reduce friction. Even returns can be improved if AI clarifies product details, refines sizing, and predicts return risk. This not only lowers high operational costs but also enhances the overall customer experience.

AI can also help brands respond faster to shifting preferences by enhancing demand forecasting, inventory management, and supply chain decisions. Over time, AI might open up entirely new consumer categories. Humanoid robotics is one emerging example at the intersection of consumer and industrial applications. Although estimates of the market potential vary widely, a quick look at Tesla’s current valuation provides some insight into the market’s excitement for humanoid robotics over the next decade.

Industrials

Industrials often operate with high fixed costs and long-lived assets, which makes improved uptime and efficiency especially valuable. Highly variable capex and economic cycles govern the profitability of many of these companies, and this lack of predictability is why many investors ascribe a below-market multiple. One of the most direct applications is predictive maintenance, shifting from scheduled maintenance to condition-based insights that anticipate failures before they occur. For airlines, railroads, utilities, and factories, this can reduce unplanned outages, extend asset life, and improve working capital efficiency. AI also supports autonomy and robotics where labor is scarce, safety matters, and consistency is critical, such as logistics, warehousing, agriculture, mining, and ports. A third area is manufacturing yield and quality optimization. AI can detect defects earlier, optimize process parameters in real time, reducing scrap and rework, and help avoid costly quality failures.

Closing Thoughts

The next decade of AI leadership likely won’t be defined by the companies building the tools. It is expected to be defined by the companies using them. Those that weave AI into mission‑critical workflows, unlock new customer value, and enhance unit economics stand to reshape industries. If past technological shifts are any guide, the enduring winners may be the appliers who translate capability into competitive advantage. For investors, spotting where AI creates structural differentiation, not just short‑term hype, will be key to capturing the next wave of long‑term value creation.

Important Disclosures

This information has been prepared by Polen Capital without taking into account individual objectives, financial situations or needs. As such, it is for informational purposes only and is not to be relied on as legal, tax, business, investment, accounting, or any other advice. Recipients should seek their own independent financial advice. Investing involves inherent risks, and any particular investment is not suitable for all investors; there is always a risk of losing part or all of your invested capital.

No statement herein should be interpreted as an offer to sell or the solicitation of an offer to buy any security (including, but not limited to, any investment vehicle or separate account managed by Polen Capital). This information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Unless otherwise stated, any statements and/or information contained herein is as of the date represented above, and the receipt of this information at any time thereafter will not create any implication that the information and/or statements are made as of any subsequent date. Certain information contained herein is derived from third parties beyond Polen Capital’s control or verification and involves significant elements of subjective judgment and analysis. While efforts have been made to ensure the quality and reliability of the information herein, there may be limitations, inaccuracies, or new developments that could impact the accuracy of such information. Therefore, the information contained herein is not guaranteed to be accurate or timely and does not claim to be complete. Polen Capital reserves the right to supplement or amend this content at any time but has no obligation to provide the recipient with any supplemental, amended, replacement or additional information.

Any statements made by Polen Capital regarding future events or expectations are forward-looking statements and are based on current assumptions and expectations. Such statements involve inherent risks and uncertainties and are not a reliable indicator of future performance. Actual results may differ materially from those expressed or implied.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This information may not be redistributed and/or reproduced without the prior written permission of Polen Capital.

Connect with Us

For more information on Polen Capital visit www.polencapital.com and connect with us on LinkedIn.