Thought Capital

Investing in India: A Cyclical or Structural Opportunity?

Key Highlights

- Despite a challenging global environment, India is projected to be among the fastest-growing nations of the next decade.

- Prospects of robust economic growth, solid corporate earnings, and favorable long-term structural tailwinds have boosted India's equity market, which is now the fourth largest in the world.

- While equity valuations may seem elevated relative to history, we believe there are still plenty of attractive opportunities for investors seeking to capture India's growth story.

India's Economic Rise

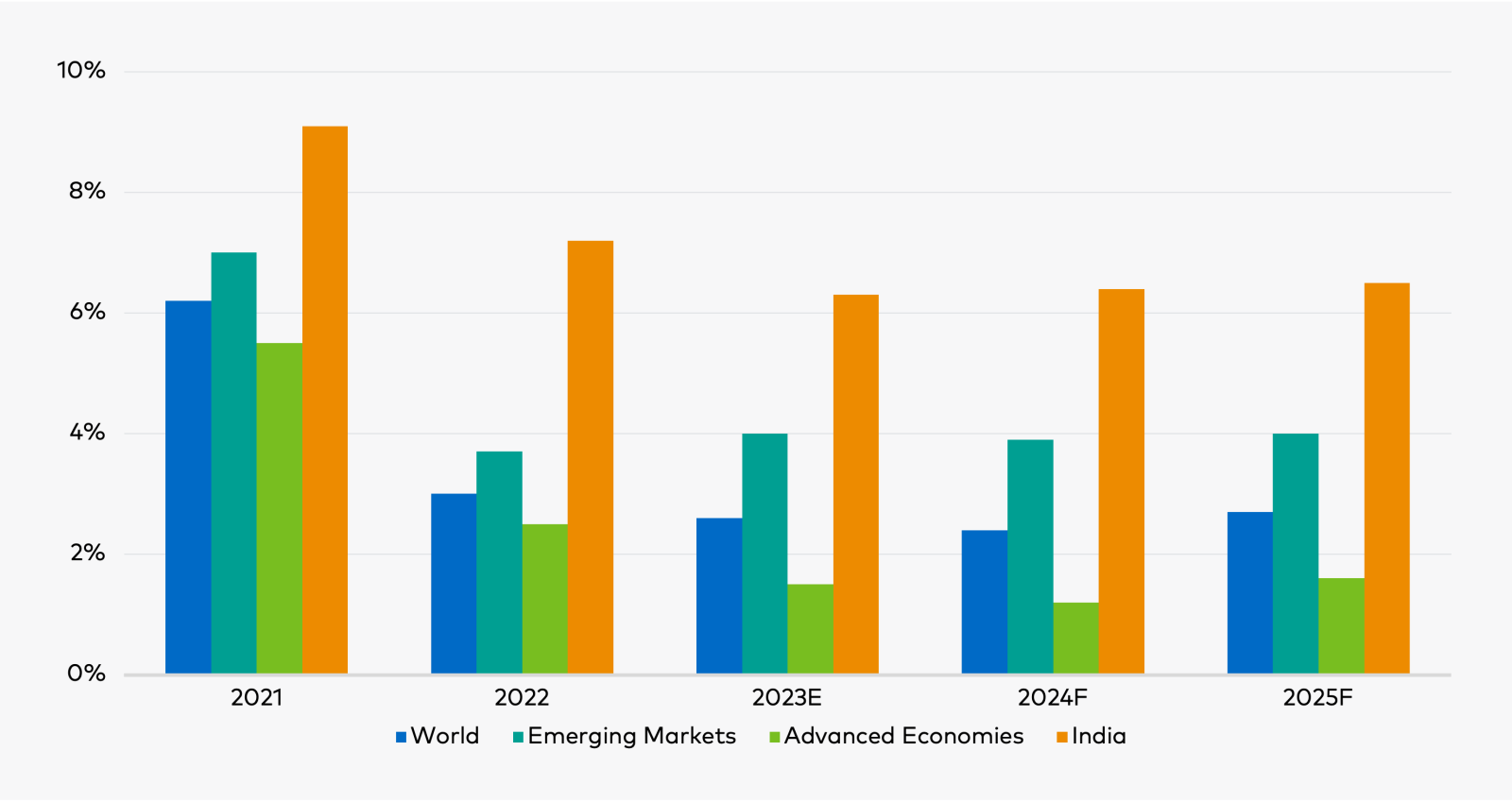

In our view, "Goldilocks" is a fitting way to describe the impressive rise of India's economy. Only a decade ago, India wasn't among the 10 largest economies in the world. Since then, the South Asian nation has swiftly moved up the rankings into the fifth spot—overtaking countries such as the U.K.—aided partly by progressive reforms and a pro-business regulatory environment1. According to the World Bank's 2024 Global Outlook, India will remain one of the fastest-growing major economies over the following years with growth expected above 6%, as seen below.

Figure 1: Real Gross Domestic Product (GDP): Change From Previous Year

Source: The World Bank: Global Economic Prospects Report. As of January 2024. Note: E = estimate; F = forecast.

Over the past two decades, the nation's economic leap has also helped significantly reduce extreme poverty2. The World Bank believes that between 2011 and 2019, India halved the share of its population living in extreme poverty . With more than 1.4 billion inhabitants—most aged below 35—the United Nations also highlighted that India overtook China as the world's most populous country last year, presenting a positive demographic outlook.

As a result, we expect India to have one of the largest working-age and middle-class populations in the years ahead, supporting its continued urbanization and industrialization and acting as an engine for consumption and investment. The rapid growth of India's consumer market and rise in disposable income have turned the country into an increasingly attractive destination for multinationals across various industries with foreign direct investment inflows (FDI) likely to reach $100 billion in the next few years3. In addition, the country has benefited from the post-pandemic diversification of supply chains by multinational companies seeking to increase their resilience to geopolitical shocks.

The Evolution of India's Financial Markets

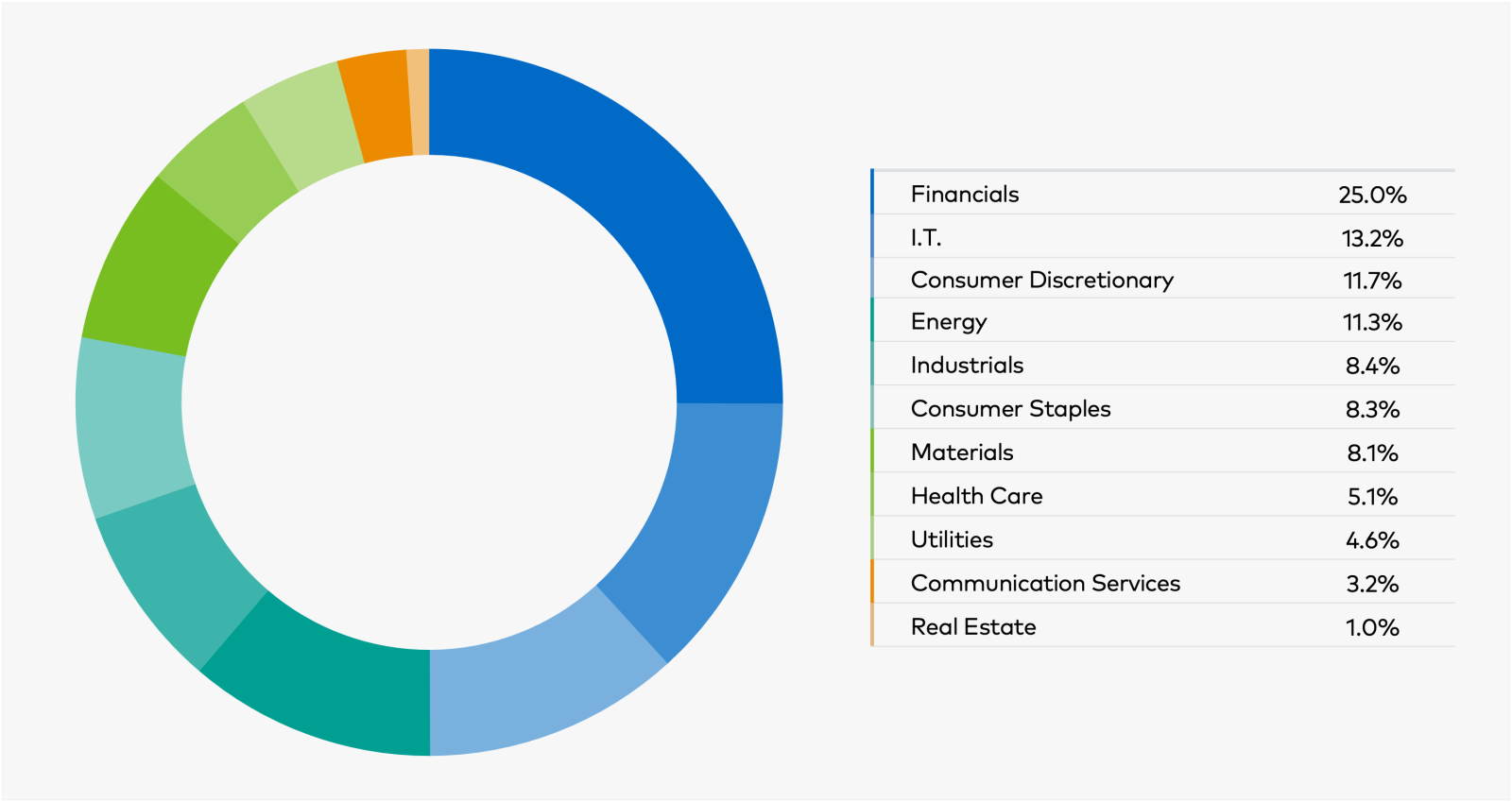

Supported by robust economic growth, a pause in interest rate hikes, and an influx of capital from domestic investors, India's Nifty 50 index recorded its eighth year of consecutive gains in 2023. The bullish momentum was widespread with large and small caps showcasing solid breadth. According to a report by Bloomberg, India's equity market capitalization surged above $4 trillion last month, positioning it as the fourth largest equity market—only behind the U.S., China, and Japan4. Figure 2 shows that India's equity market is highly diversified, providing investors with a broad, investable universe.

Figure 2: MSCI India Index Sector Composition

Source: Bloomberg. As of January 31, 2024.

While equity markets took center stage in 2023, we believe credit markets could see billions of dollars in inflows in the coming years. Last September, JPMorgan unveiled plans to include Indian government bonds in its emerging market index starting in mid-2024, which has $213 billion benchmarked to it5. Earlier this year, Bloomberg announced similar plans starting in September 20246. In our opinion, the evolution of India's credit market can be attributed in large part to the country's positive track record of fiscal discipline, sound monetary policy, and price stability.

India Outlook: A Multi-Decade Growth Story

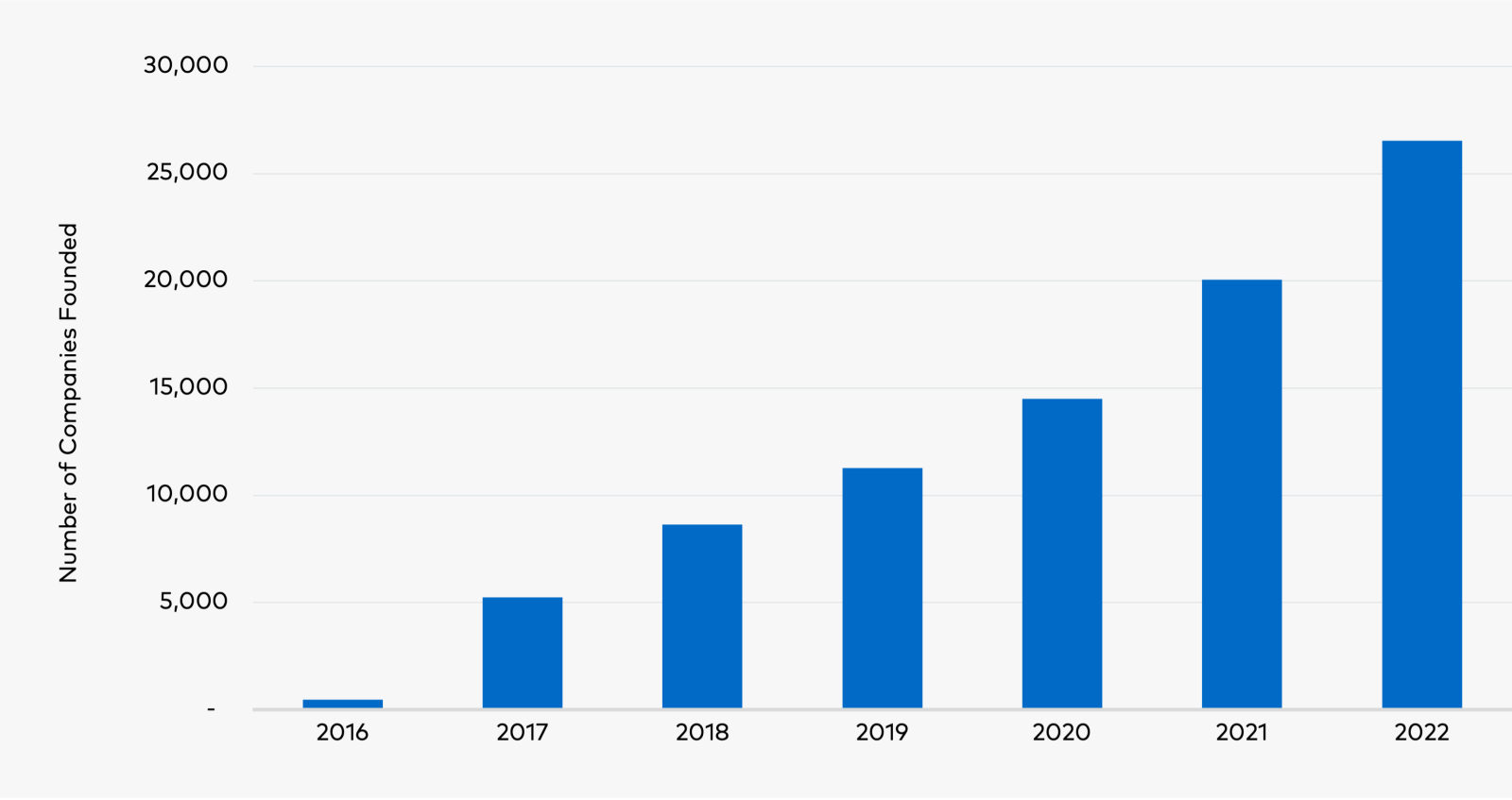

Last year, our investment team visited India, where we experienced the vibrant energy and buoyancy of the local economy. Compared to our past trips to the country, we witnessed a meaningful pickup in entrepreneurial activity and dynamism across the private sector, as illustrated in Figure 3.

Figure 3: Indian Start-Up Ecosystem – Entrepreneurial Activity in India

Source: India's Department for Promotion of Industry and Internal Trade. As of December 2022. Latest data available.

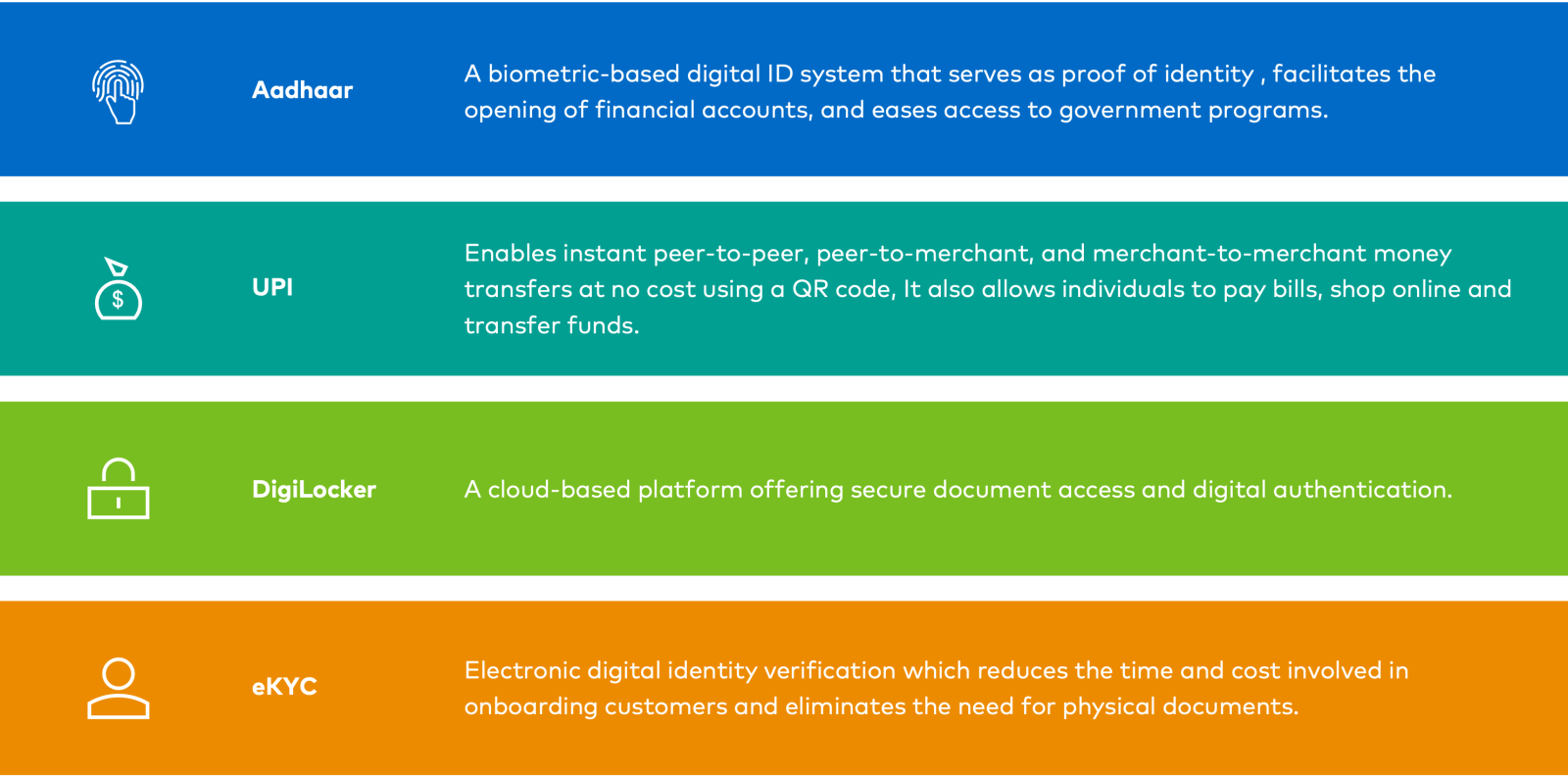

In the last few years, there have been groundbreaking advancements in India's public digital infrastructure, commonly known as the Tech Stack. As seen in Figure 4, the Teck Stack is built on four key pillars, including Aadhaar's unique identification number, the Unified Payments Interface (UPI), a digital locker, and e-know-your-customer (eKYC).

Figure 4: The Four Pillars of India's Tech Stack

Source: Polen Capital.

India's digital revolution has not only fueled rapid innovation and reduced friction across the economy but also accelerated long-term secular trends, including e-commerce, mobile payments, telemedicine, artificial intelligence, and the democratization of credit. We believe these catalysts will help usher new corporate domestic champions, driving the potential for superior earnings growth.

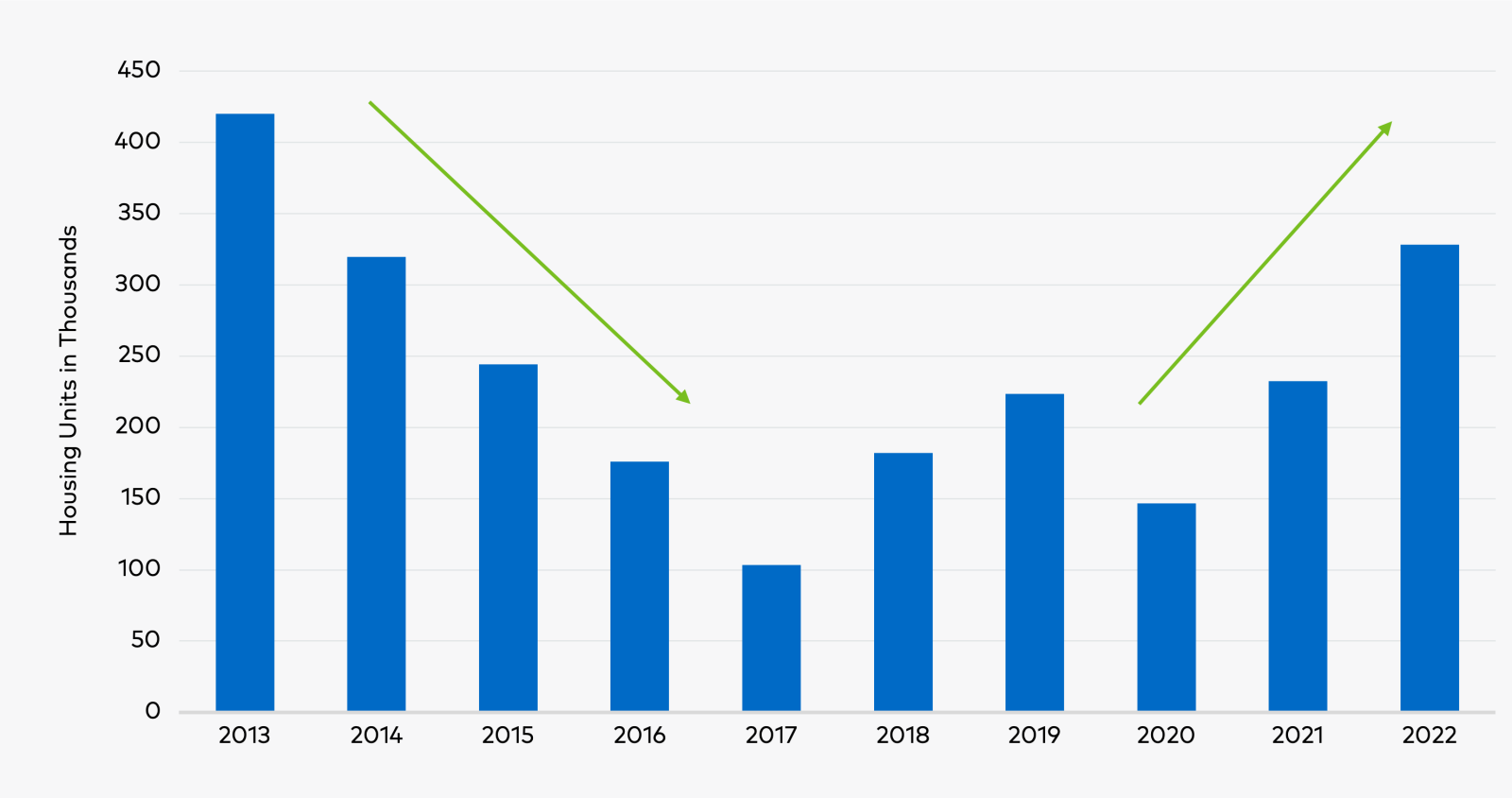

Furthermore, as seen below, the residential market has resumed its growth trajectory after facing challenges over the past several years. We believe that a pause in interest rate hikes, robust demand for luxury housing, and investments by Indians living abroad boosted developers, marking a stark contrast with many other countries currently facing severe dislocations in the real estate sector.

Figure 5: India's Residential Property Launches

Source: Statista. As of December 2022. Latest data available.

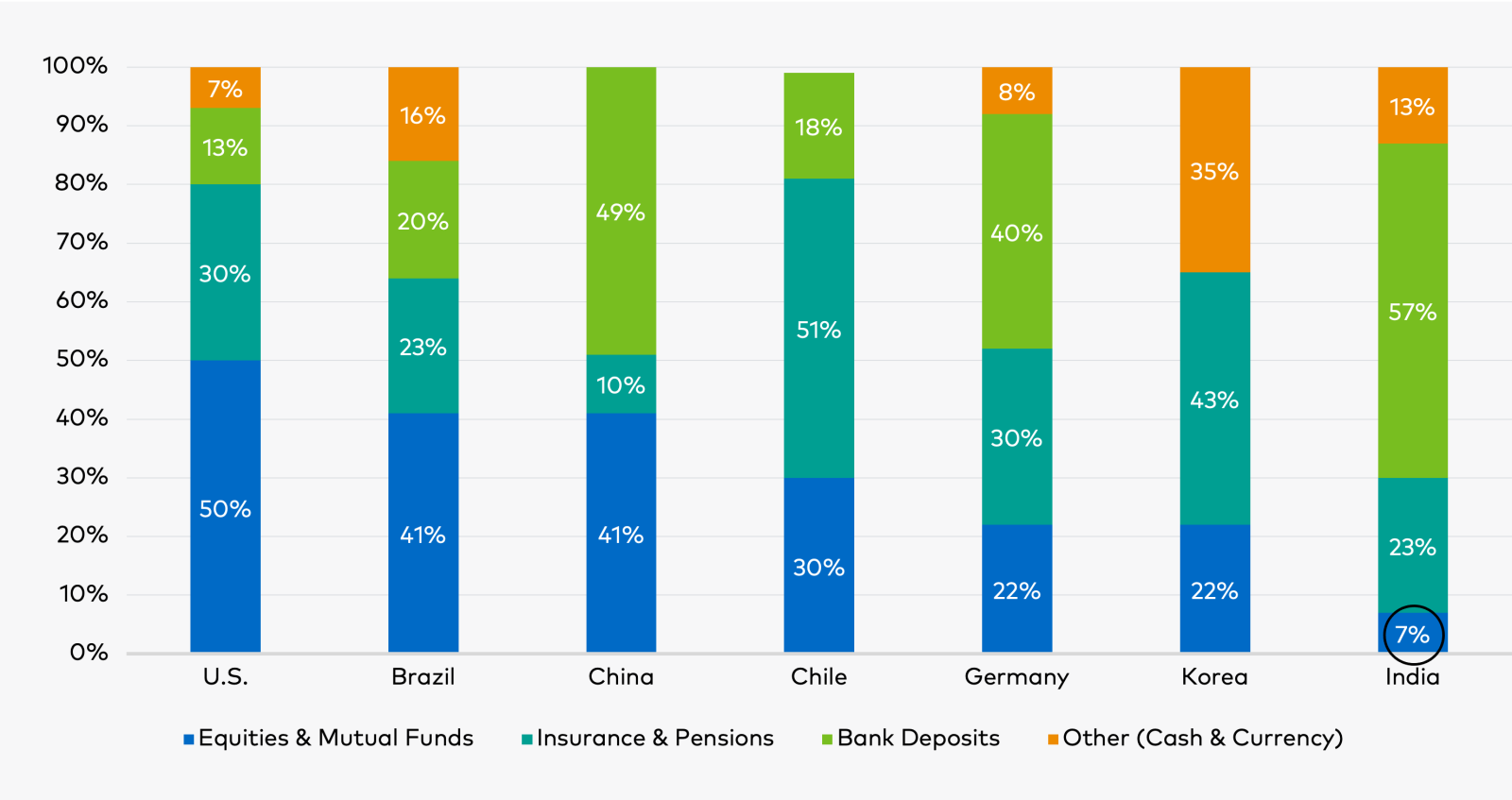

For one, the financialization of household savings, deep smartphone penetration, and the emergence of local trading platforms have helped democratize the investment landscape, enabling millions of retail investors to access the market. Looking forward, we believe that the retail space has ample runway for growth, given that there were only about 40 million unique mutual fund investors in the country of over 1.4 billion people7.

As shown in Figure 6, domestic household exposure to equities remains relatively low at 7% of financial assets, compared to an average of 30% for other emerging markets, suggesting considerable room for augmenting equity allocations8.

Figure 6: India's Composition of Household Financial Assets

Source: Bloomberg Intelligence. As of December 2023.

In turn, positive corporate results have catalyzed domestic inflows, keeping valuations of Indian equities elevated. According to Bloomberg, earnings for Nifty 50 companies are projected to rise about 15% in 2024, marking a fourth straight year of double-digit profit growth9.

Investor Takeaways

While we believe several secular tailwinds support our constructive view on India's economy, our research indicates that some areas of the Indian equity market appear expensive. Hence, we do not dismiss the possibility of bouts of volatility down the road. On the political front, the biggest display of democracy will soon present itself as 912 million registered voters will get a chance to choose if Prime Minister Modi is to remain in office. The consensus anticipates Modi to be re-elected, though, at state-level elections, his party has lost some key states. In a scenario where consensus is proved wrong, we could witness a significant correction in India's premium.

With equity multiples already trading at high levels relative to history, maintaining valuation discipline will be critical to navigating Indian markets. Therefore, our view is that investors should favor higher-quality businesses with sustainable competitive advantages and employ a long-term approach, as we are optimistic that India's best years are still yet to come. At Polen Capital, we believe that India's structural growth story will continue to unfold over the following decades, paving the way for the emergence of many innovative companies along the way.

Important Disclosures

1Top five largest economies include the U.S., China, Japan, Germany, and India (based on GDP). Source: Bloomberg. As of January 2024.

2The World Bank defines “extreme poverty” below $2.15 per person per day, (2017 PPP). Source: World Bank Poverty and Inequality Portal and Macro Poverty Outlook, Spring 2023.

3Source: Reuters. As of January 2024. India Eyes $100B Annual Foreign Direct Investment

4Source: Bloomberg. As of January 2024. India Overtakes Hong Kong as World's Fourth Largest Stock Market - Bloomberg

5JPMorgan Government Bond Index Emerging Markets. Source: JPMorgan. September 2023 Press Release.

6Under Bloomberg’s proposal, the inclusion of India FAR (Fully Accessible Route) bonds in the Bloomberg EM Local Currency Indices is to be phased in over a 5-month period. FAR bonds are securities that have no investment curbs for foreigners.

7Source: Bloomberg. As of December 2023. Inside the Record Year for India's $585 Billion Mutual Funds Industry

8Source: Bloomberg. As of January 2024.

9Source: Bloomberg. As of December 2023. Record Eight-Year Winning Streak Seen Extending for India Stocks - Bloomberg

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of February 2024 and may involve a number of assumptions and estimates that are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This document is provided on a confidential basis for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital.

Definitions:

The MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 131 constituents, the index covers approximately 85% of the Indian equity universe.

The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange. Nifty 50 is owned and managed by NSE Indices, which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited.

The JPMorgan Government Bond Index-Emerging Markets (GBI-EM) indices are comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments.

The Bloomberg Emerging Markets Local Currency Government Index is a flagship index that measures the performance of local currency Emerging Markets (EM) debt.

Gross Domestic Product (GDP) measures the monetary value of final goods and services produced in a country in a given period of time.