Know What You Own: Stocks vs. Businesses

We believe it is crucial for investors not to become transfixed on short-term stock price movements and instead remain focused on business fundamentals.

The Importance of Thinking About Stocks as Businesses

Successful business owners are often said to be able to feel the pulse of the companies they lead. For instance, great restaurateurs know what dishes are most popular on the menu, who their regular patrons are, when food suppliers will deliver fresh ingredients, and how much revenue is needed to cover operational expenses such as salaries and rent.

While a thorough understanding of a business’ financial health and long-term strategy may seem logical for the success of any investment, we often see cases where investors forget that shares of a company represent an ownership interest in an underlying business and instead treat them as digital lottery tickets seeking to capture the latest market rally or trend. As a result, they overlook a company’s fundamentals and behave like speculators, buying shares with the hope that someone else will pay a higher price down the road.

The rise in popularity of speculative assets over the past decade—including unprofitable companies, cryptocurrencies, and nonfungible tokens (NFTs)—are examples of how some investors can get caught up in the enthusiasm and momentum of market rallies. Notably, the heavy losses incurred in some of these asset classes following their market tops should remind us that speculative ebullience rarely leads to sustainable long-term wealth creation.

Having a Business Owner's Mindset

Famed investor and writer Peter Lynch is quoted saying that one of the most important investing principles is to “know what you own and why.” According to Lynch, most market participants cannot explain in a few sentences why they own a stock aside from expecting its share price to increase. One common misconception is looking at stock prices and thinking that they reflect the actual value of a business.

In reality, a company’s share price is determined by what the market is willing to pay at a given time, while its value reflects its true worth based on its underlying characteristics. While prices can fluctuate daily due to short-term fluctuations or investor sentiment, the intrinsic value of a business is independent of its market price and, hence, doesn’t fluctuate very often unless there is a material change in the company.

However, in today’s world, it is easy to become distracted by the daily barrage of news, data reports, predictions, and investment advice. Therefore, we believe it is vital to approach investing from the lens of a business owner rather than a speculator, separating the signal from the noise. The graphic below shows what we view as some differences between investors and speculators.

Figure 1: What Differentiates Investors from Speculators?

Source: Polen Capital

What Does Investing Like a Business Owner Mean?

In our experience, investors who navigate markets through the lens of a business owner tend to favor high-quality companies with sustainable cash flows and enduring competitive advantages. After all, very few people would likely justify allocating capital to a cash-burning business with weak growth prospects over an industry-leading company with robust financials and a long growth runway.

Furthermore, while the fear of missing out and the daily ups and downs of the market might tempt us to behave impulsively by acting first and thinking later, we believe that exercising patience and conducting thorough due diligence before making decisions are vital components of any long-term investment strategy. Rather than trying to be the first to hop on a new trend or hot company, we believe that taking our time to truly understand a company’s prospects is critical in assessing the sustainability of its competitive advantages.

In our view, a business owner’s mindset and a long investment horizon are inextricably linked. In contrast to speculators who seek to buy low and sell high, business owners rarely have an incentive to sell their stakes in great companies. Warren Buffett once stated that when he owns portions of great businesses with outstanding management teams, his favorite holding period is forever.1 According to our research, exceptional companies can compound their intrinsic value over several decades, not just years, maximizing their potential to generate superior earnings growth.

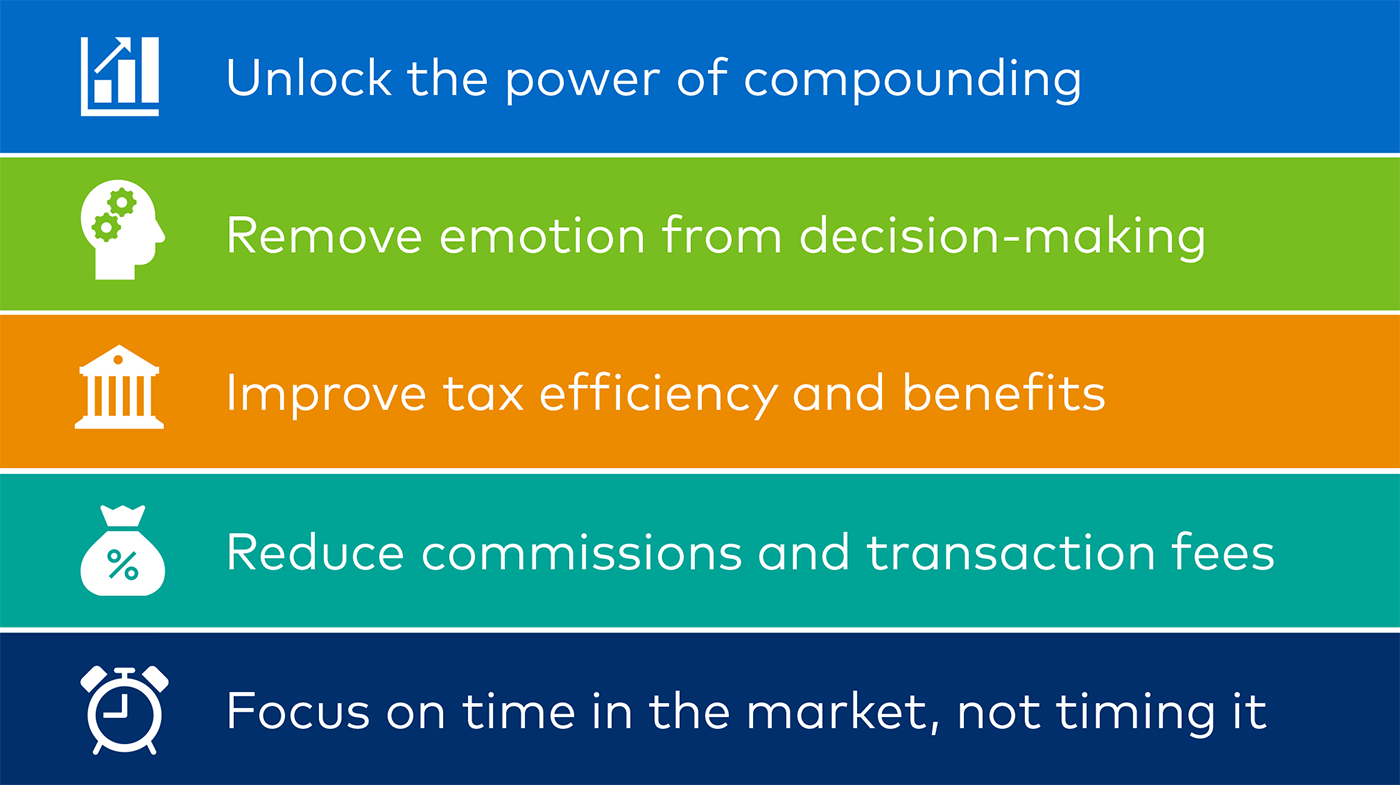

This is why we think knowing what you own—and why—is critical in today’s market environment. During periods of elevated uncertainty, speculators who lack a business owner’s mindset will attempt to time the market, possibly diminishing profits or incurring losses along the way. In contrast, investors who own great companies tend to feel more comfortable staying the course when volatility strikes the market, increasing their likelihood of reaping the rewards typically associated with long-term investing, as seen in Figure 2.

Figure 2: The Potential Rewards of Long-Term Investing

Source: Polen Capital

We also believe that thinking like a business owner supports the case for maintaining a concentrated portfolio consisting only of high-conviction ideas since it is more difficult to fully understand and closely monitor a strategy with many companies compared to only focusing on 20 or 25 high-quality businesses.

Lastly, investors should be discerning and exercise critical thinking instead of depending on screens and models when making decisions. After all, some of today’s leading businesses are driven by a combination of moats that are hard to identify simply by looking at quarterly reports and spreadsheets, such as powerful cultures, high-performing talent, and brand loyalty.

“We truly believe that focusing on owning businesses and not on buying stocks that go up and down gives us a significant advantage over others that tend to buy and sell stocks more frequently.”

– David Polen, Founder of Polen Capital.

Important Disclosures

1 Berkshire Hathaway 1989 letter to shareholders.

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of March 2024 and may involve a number of assumptions and estimates that are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice.

Definitions:

Special purpose acquisition company (SPAC): An empty shell company that goes public, raises money in an initial public offering, and then uses that money to merge with some private company, which will thereby become public. (Source: Bloomberg).