Public Credit Strikes Back: The Growth of Unitranche Financing

Private credit has stood at the forefront of innovation over the past decade, providing flexible alternatives to traditional financing. However, bank lenders have taken notice and are striking back with their own bespoke credit solutions.

Key Highlights

- Over the past decade, private credit has evolved from a niche market to a compelling asset class due to a pullback in bank lending, a higher-for-longer interest rate environment, and its potential to generate attractive returns.

- Unitranche loans offered by direct lenders—such as private credit funds—have become an attractive funding source for corporate borrowers, given their simplicity, flexible structure, and execution speed.

- In response, banks and traditional lenders have innovated new vehicles like the so-called “public unitranche,” which has its own set of distinctive characteristics and benefits for borrowers.

- Despite the rise of private credit, our outlook for the syndicated loan market remains robust. We also view the increased competition between public and private credit providers as a positive trend for the leveraged credit market.

- We believe the current backdrop has set the stage for several attractive long-term opportunities for investors looking to allocate capital across the credit spectrum.

The Evolution of Private Credit

In the aftermath of the Global Financial Crisis of 2007-09, credit markets became fertile ground for innovation. Following the fallout of several institutions, policymakers enacted reforms—known as Basel III—aimed at strengthening the financial system. With banks focusing on de-risking their balance sheets, corporate lending virtually dried up for all but the largest and most established companies, given tighter credit conditions and higher minimum requirements for public debt issuance.

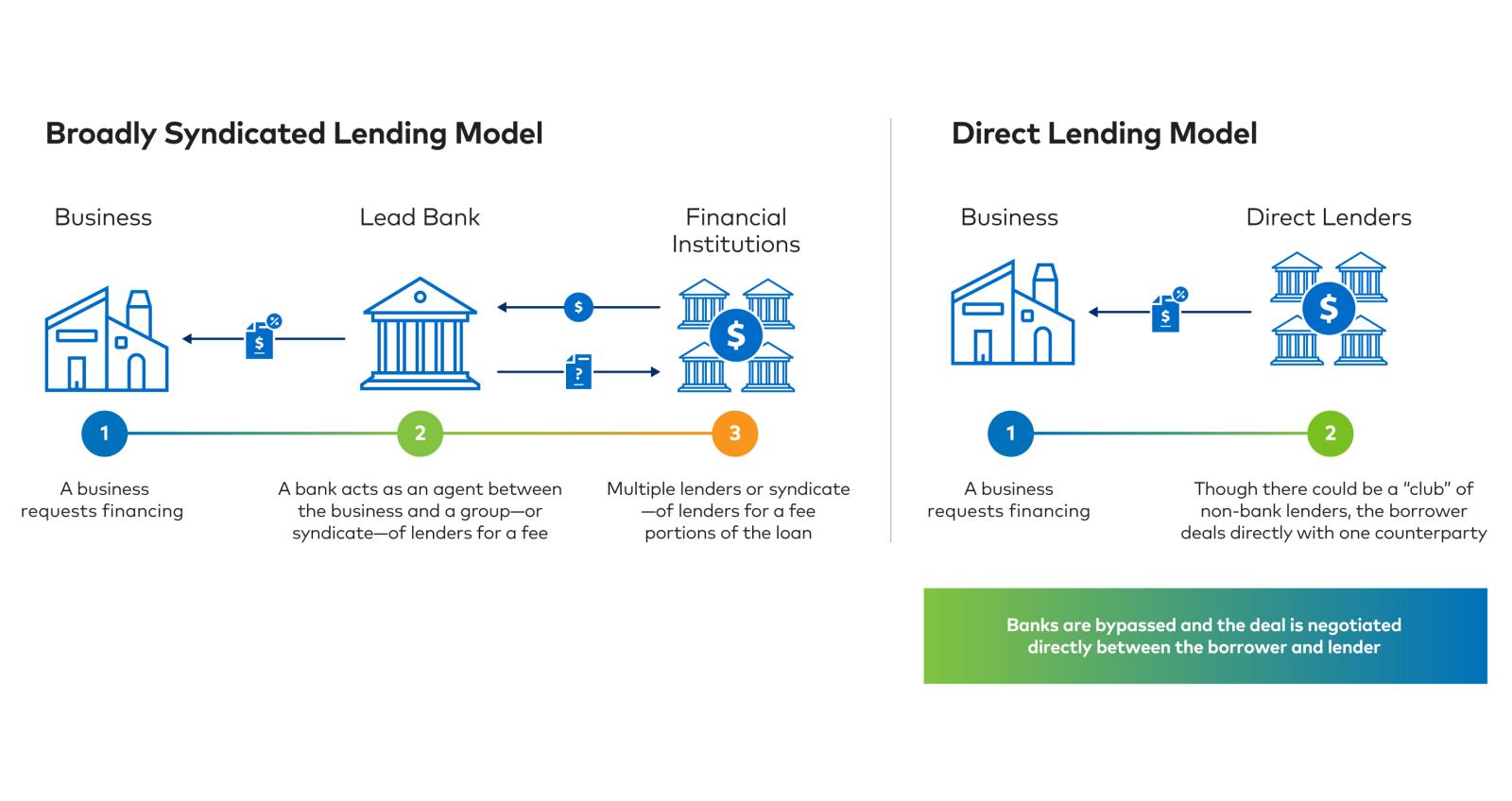

However, riskier businesses—such as those with high leverage levels—were not the only ones that faced difficulties accessing capital. Newer companies without established track records, smaller firms, and innovative enterprises with untested products or business models faced similar challenges. As a result, the retrenchment of banks left a vast financing void in the system, creating an opportunity for an emerging group of direct lenders willing to offer alternative solutions, as seen in Figure 1.

Figure 1: Syndicated and Direct Lending Strategies

Source: Polen Capital.

Though direct lending from non-bank institutions—such as private credit funds and asset managers—has a long history tracing back to the 1980s, it was not until after the Global Financial Crisis that it solidified its role as a critical part of the credit ecosystem. In recent years, the private credit market has become one of the fastest-growing segments of finance.

For example, dry powder has nearly quadrupled since 20141, and private credit firms currently hold more than $400 billion in capital waiting to be deployed.2 Following the dislocations stemming from the COVID-19 pandemic and the aftermath of Silicon Valley Bank’s collapse, private credit—which offers a financial solution with tailored and flexible features—has increasingly gained market share from traditional lenders in areas such as leveraged buyouts.

The Allure of Unitranche Loans

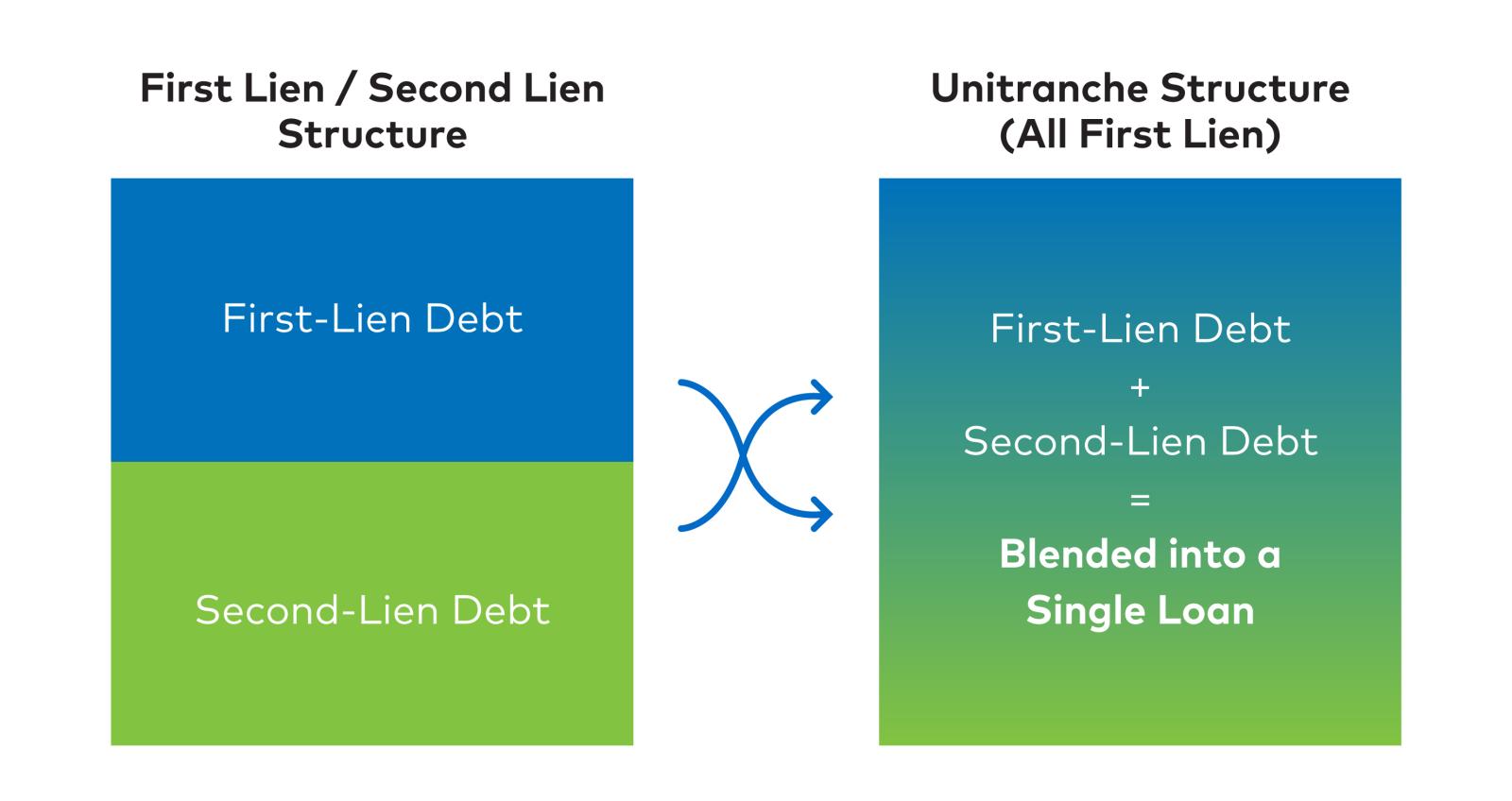

Unitranche financing is an example of a loan structure that has surged in popularity among leveraged borrowers. At a high level, a unitranche debt deal is an alternative to the more traditional first and second lien structure. The unitranche facility combines a first lien and second lien loan—blending senior and junior interest rates—into one tranche of debt, as seen in Figure 2.

Figure 2: Unitranche Financing Structure

Source: Polen Capital.

One of the main advantages of unitranche financing lies in its simplicity. In the case of first and second lien debt, the borrower deals with a syndicate of lenders, and each tranche operates separately, requiring its own credit agreement, security, and covenants. In contrast, borrowers going the private route with a unitranche structure usually go through a simplified negotiation process with fewer documentation requirements, given that they only have a single loan agreement.

Importantly, given that unitranche facilities do not require an agency’s rating or involve marketing roadshows—unlike conventional sources of financing—the closing process tends to be more streamlined compared to first and second lien financing. Quicker execution has been a critical reason why unitranche financing has become popular for acquisition deals, where exclusivity periods impose tight deadlines.

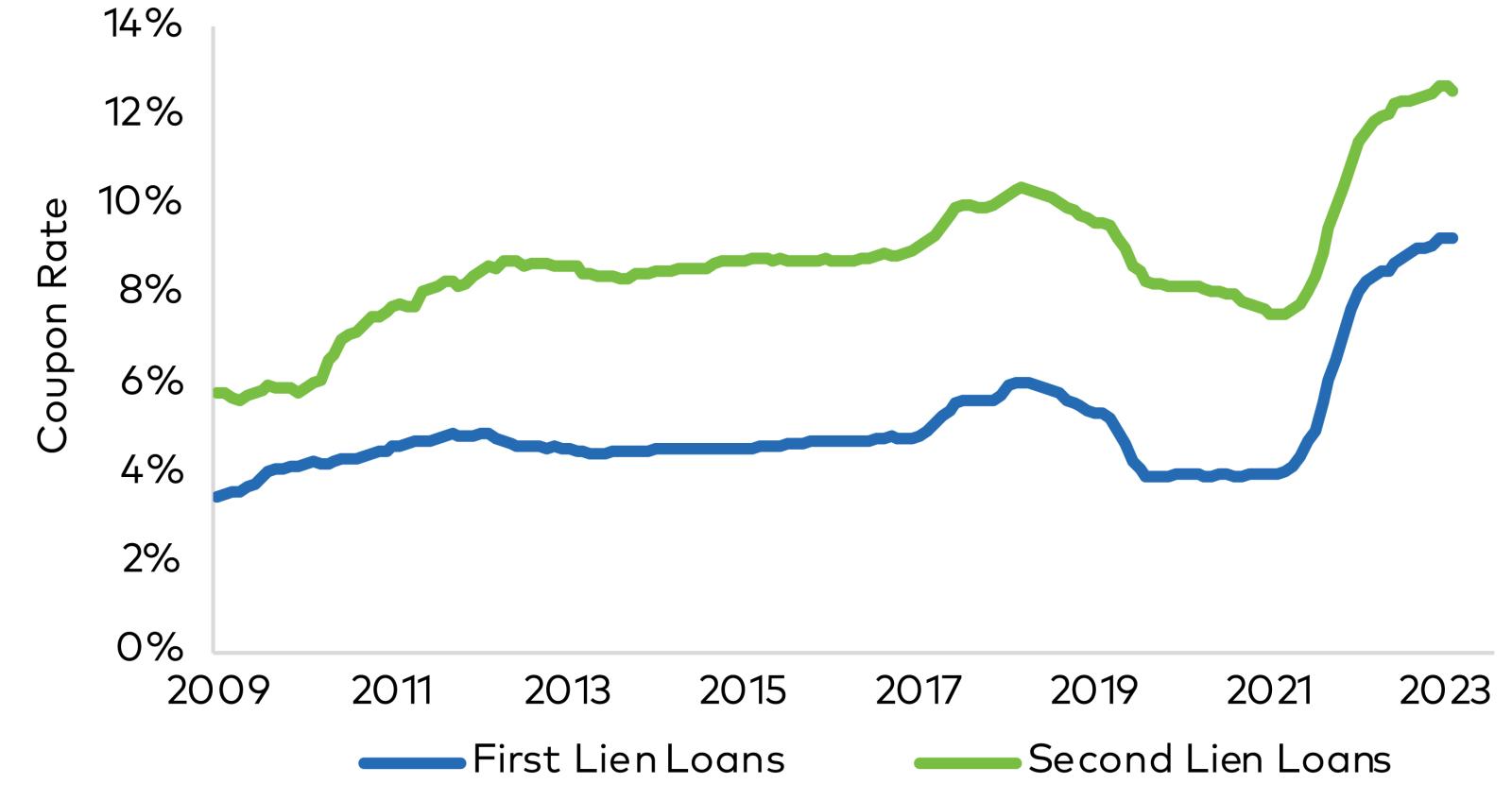

The price dispersion between first and second lien loans resulting from the current higher interest rate environment has also contributed to this trend. As seen in Figure 3, the traditional model of funding a leveraged buyout (LBO) with a first and second lien financing has become increasingly more expensive in recent years.

Figure 3: Credit Suisse Leveraged Loan Index Coupon Rates

Source: Bloomberg. As of January 2024.

Unitranche Deals Go Public?

Given the rise of unitranche deals, traditional lenders have begun innovating their own version of the structure. Though the so-called “public unitranche” facilities are still a relatively new credit product, a report by Reuters stated that there is momentum behind these solutions given that they can be a cheaper alternative compared to their private counterparts.3

In our view, the proliferation of new financing options is a positive trend worth monitoring, and we expect this trend to continue gaining traction given heightened interest rates and the benefits of the unitranche structure for borrowers.

Furthermore, though there is yet to be standardization in the structure of the public unitranche, recent deals have offered both a floating rate loan and fixed rate bond structure, which rank equally in a company’s creditor hierarchy. This new structure typically provides better downside protection than a junior debt investment, which may have a lower ranking in the capital structure. The public unitranche version also essentially doubles the universe of potential lenders to draw from while still giving issuers favorable prepayment options as part of the contract, particularly on the loan portion of the unitranche.

Investor Takeaways: In Credit, One Size Doesn’t Fit All

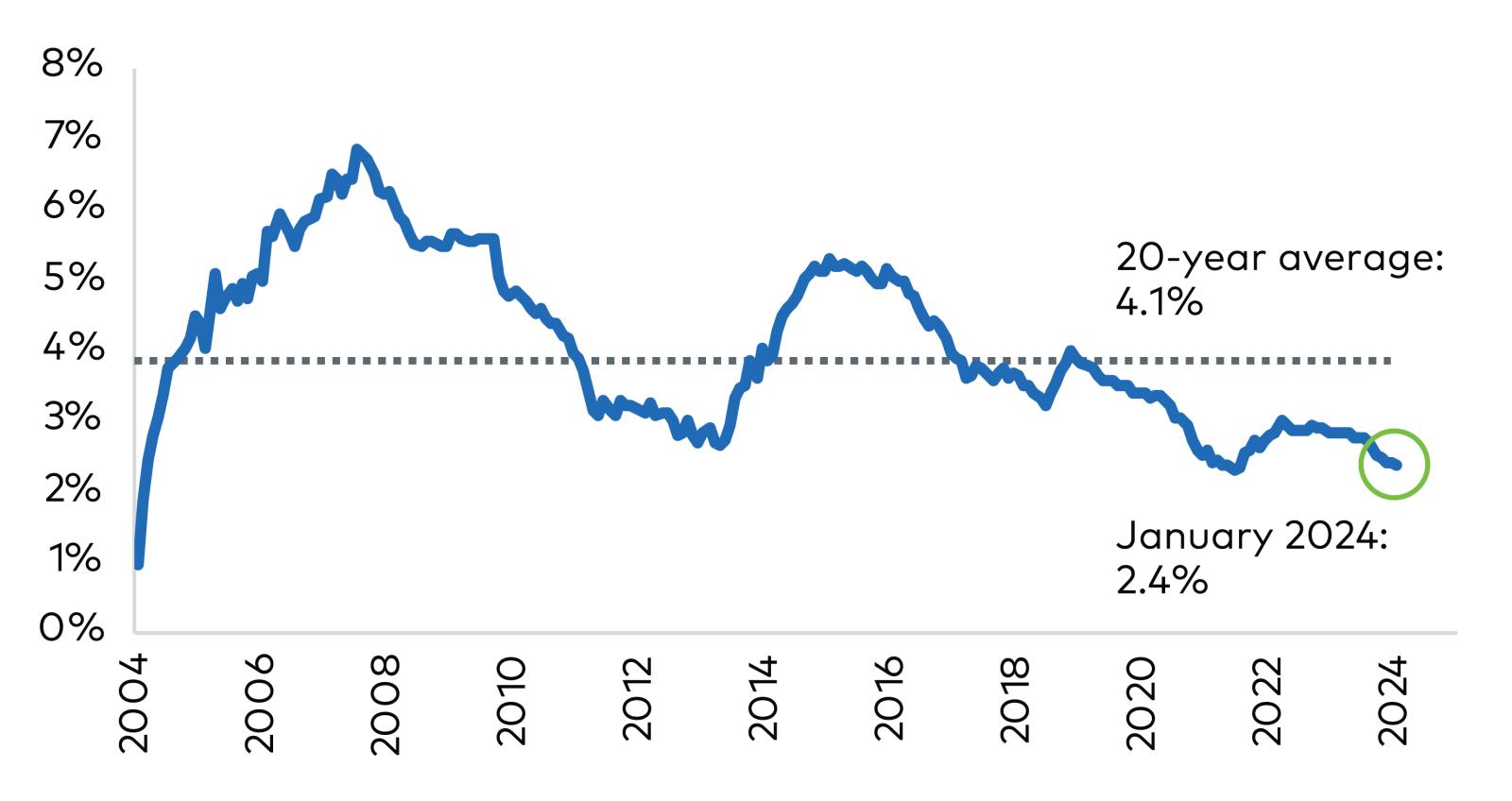

Going forward, we expect a further reduction in the amount—both in terms of volume and number of issuances—of second lien loans outstanding. According to our research, second lien loans have historically represented a small portion of the leveraged loan market, averaging just over 4% over the past 20 years.

However, mainly due to private credit taking share from the public leveraged loan market since the Great Financial Crisis, the percentage that second lien loans represent of the total loan market is hovering at multi-decade lows, as shown in Figure 4. If the unitranche trend in public leveraged credit markets takes hold as we expect, our view is that second lien loan issuance will remain under pressure for the foreseeable future.

Figure 4: Second Lien Loans % of the Leveraged Loan Market

Source: Pitchbook, Barclays Research.

While we believe private credit has emerged as an attractive asset class for investors seeking diversification and the potential to earn attractive returns, our outlook for the syndicated loan market remains robust. Though some borrowers may see advantages from tapping into private credit, our view is that many would still benefit more from financing through the more broadly syndicated loan market.

Therefore, we believe one size does not fit all regarding credit. Both public and private credit markets are complementary sources of capital that help lubricate and diversify the broader financial system. As such, we see healthy competition continuing to take place between public and private markets for issuance opportunities, as borrowers' access to a variety of financing solutions will remain vital in the ever-evolving world of leveraged finance.

Important Disclosures

1Source: U.S. Federal Reserve. Private Credit: Characteristics and Risks.

2Source: S&P Global, PreqinPro. As of December 2023. Buying Time Post-Default with Private Credit.

3Peck, G.R., Fortun, G. and Vaccaro Padrón, L. (2023) Current Developments in Unitranche Financing, Practical Law: The Journal. (Accessed: 15 March 2024).

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of March 2024 and may involve a number of assumptions and estimates that are not guaranteed and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The information in this document has been prepared without taking into account individual objectives, financial situations or needs. It should not be relied upon as a substitute for financial or other specialist advice. This document is provided on a confidential basis for informational purposes only and may not be reproduced in any form or transmitted to any person without authorization from Polen Capital.

Definitions

The Global Financial Crisis was a severe worldwide economic crisis. The National Bureau of Economic Research dates the recession around this crisis from Dec-2007 through Jun-2009.