Small Company Growth Perspectives: Attractive Hunting Grounds for Potential Long-Term Compounders

Polen’s Small Company Growth Team reflects on what they see as a unique moment in the market.

Distinguishing the Signal from the Noise

After nearly two years of debating if the economy is headed into recession, small company valuations are all but pricing it in as an eventuality. Still, market sentiment on small caps remains pessimistic, with many investors taking a “wait-and-see” approach. In our view, long-term-oriented investors who stay on the sidelines may risk missing out on a unique moment in time.

It’s worth reflecting on how we got here. In 2022, the foremost issue was the direction of inflation and, by extension, rising interest rates. This led to a knee-jerk reaction whereby investors quickly repriced growth assets. This repricing made sense for many growth stocks that were trading at nosebleed valuations yet had business models with questionable long-term viability.

The bigger issue, however, was that many growth companies with profitable, healthy balance sheets and other quality features were being treated the same way. Times like this are exceedingly rare and signaled to us an opportunity, the likes of which we had not seen for well over a decade. Many companies that had previously been either too expensive or outside the small cap market range were now back in the opportunity set.

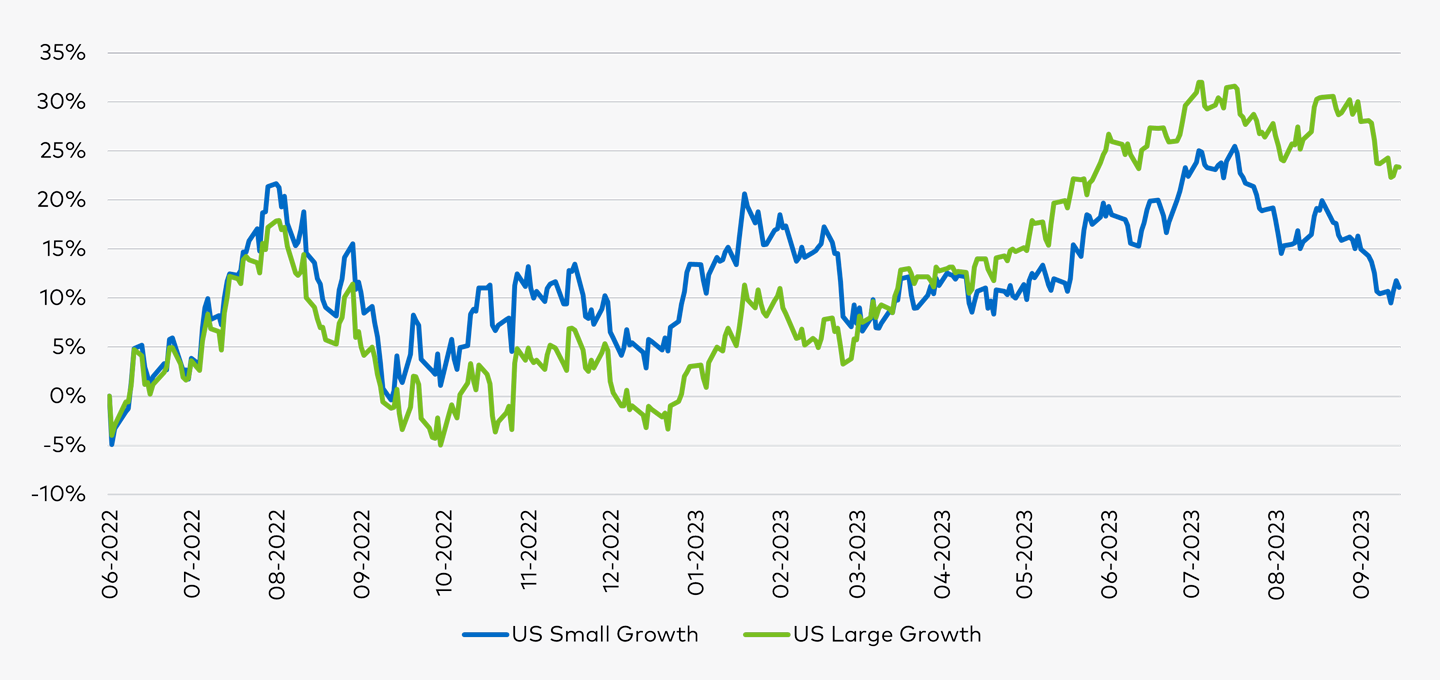

Heading into 2023, there was some optimism that inflation was cooling and the economy would find itself on better footing. Small caps responded to this with the Russell 2000 Growth Index rising from its June 2022 low to outperform the Russell 1000 Growth Index by 9% through early March 2023. However, with the collapse of Silicon Valley Bank and ensuing broader concerns around the possibility of credit contagion, the outperformance of small caps was temporarily derailed again by investors’ pessimistic, cautious outlook on the asset class (Figure 1).

Figure 1: Prior to Silicon Valley Bank, Small Caps Were Leading Large Caps

Source: Bloomberg, Polen Capital. As of 9/30/2023. Chart shows cumulative returns from the Russell 2000 Growth bottom on 6/15/2022. “US Large Growth” refers to the Russell 1000 Growth index, and “US Small Growth” refers to the Russell 2000 Growth index. Past performance is not indicative of future results.

At Polen Capital, we don’t seek to invest in the whole small cap universe or anything close to it. Being among the most concentrated managers in the space allows us to keep our bar for quality very high. We believe this asset class is among the best hunting grounds for companies that have the potential to compound growth for a long time. However, most companies don’t possess the traits to do this. That is why we only aim to invest in what our extensive research suggests are the most competitively advantaged companies with robust business models (profitable, strong balance sheets), experienced management teams, and long runways to reinvest in the business over time.

Looking Ahead in Small Company Growth: Key Takeaways for Investors

While many can speculate on the trajectory of interest rates or the possibility of a recession, we find it’s more beneficial to focus on what we know and concentrate our investments on companies that we anticipate will thrive over the next five years. The current opportunity set is more robust than we’ve seen in a very long time with attractive valuations laying the groundwork for higher expected returns in the broader small-cap universe. Earnings estimates have trended downward over the past year, establishing a more modest baseline for expectations moving forward. Lastly, we see many small companies that are judiciously seizing the opportunity to optimize their operations, drive efficiencies, and position themselves well to both expand margins and deliver accelerated earnings growth in the year ahead. These strategic moves, coupled with revenue growth acceleration, wield significant power, in our view.

Important Disclosures

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of November 2023 and may involve a number of assumptions and estimates which are not guaranteed, and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness, or accuracy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The volatility and other material characteristics of the indices referenced may be materially different from the performance achieved by an individual investor. In addition, an investor’s holdings may be materially different from those within the index. Indices are unmanaged and one cannot invest directly in an index.

The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. The index is maintained by the FTSE Russell, a subsidiary of the London Stock Exchange Group.

The Russell 2000® Growth Index is a market capitalization weighted index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes Russell 2000® Index companies with higher price/book ratios and higher forecasted growth values. The index is maintained by the FTSE Russell, a subsidiary of the London Stock Exchange Group.

Definitions:

Silicon Valley Bank (SVB) was shut down in March 2023 by the California Department of Financial Protection and Innovation, following a reduction in the value of its investments and significant asset withdrawal from depositors. Later in March, First Citizens Bank bought up all deposits and loans of the failed bank. SVB was the largest U.S. bank to fail since the financial crisis of 2008.