Thought Capital

3 Reasons for a Strategic Allocation to High Yield

Many investors exclude high yield from their strategic asset allocations due in part to its perceived likeness to equities. Another common investor belief is that the best use of capital is to invest in high yield only when spreads are wide and to do so for only a limited holding period until spreads tighten.

We disagree with that thinking, though we acknowledge that high yield investors should expect higher returns when spreads are wide and the market is “cheap.” The problem is that, in our experience, high yield—like most markets—is difficult for even a sophisticated investor to accurately time. We believe that instead of taking a tactical approach, investors should consider high yield as a component of their strategic asset allocation within a diversified portfolio.

Our Thinking

1. High yield can offer an incremental layer of diversification, given its lack of correlation with fixed income and a risk profile that is meaningfully different from equities.

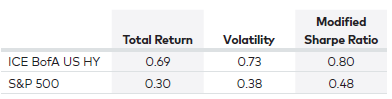

Although high yield and equity markets have produced similar total returns over the last 25 years, there is a clear difference in their risk-adjusted performance, primarily due to high yield’s lower volatility. Therefore, even though the correlation between the two asset classes is relatively high, the two markets provide distinct risk and reward profiles for investors. Conversely, high yield’s correlation to more traditional “core” fixed income markets, which typically are included as a strategic allocation within most portfolios, is relatively low. The low correlation means that adding high yield as a strategic allocation can offer an investor the opportunity to increase yield while further contributing to overall diversification.

Exhibit 1A: Correlation with ICE BofA US HY Index Returns for Periods Ending December 31, 2023

Source: Bloomberg as of December 31, 2023

Exhibit 1B: Long-Term Risk and Return Characteristics, January 1, 1998 to December 31, 2023

Source: Bloomberg as of December 31, 2023

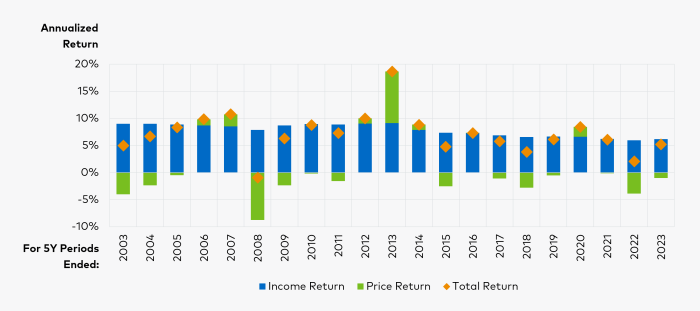

2. Over the long term, coupon income, rather than price appreciation, accounts for almost all of the high yield market’s return.

Generally, high yield bonds have a shorter maturity and a higher coupon than investment grade bonds. This coupon serves as a powerful driver of long-term investment outcomes. Breaking down the drivers of total return, as shown in Exhibit 2 for historical rolling five-year periods, we see that even in down markets, coupon income, for the most part, more than offset any associated capital losses.

Exhibit 2: Decomposition of ICE BofA US HY Index Returns for Rolling 5Y Periods, 2003-2023

Source: Bloomberg as of December 31, 2023

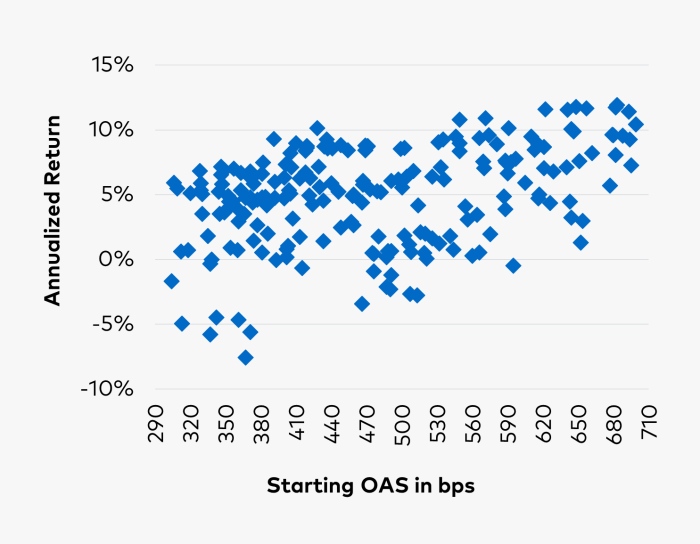

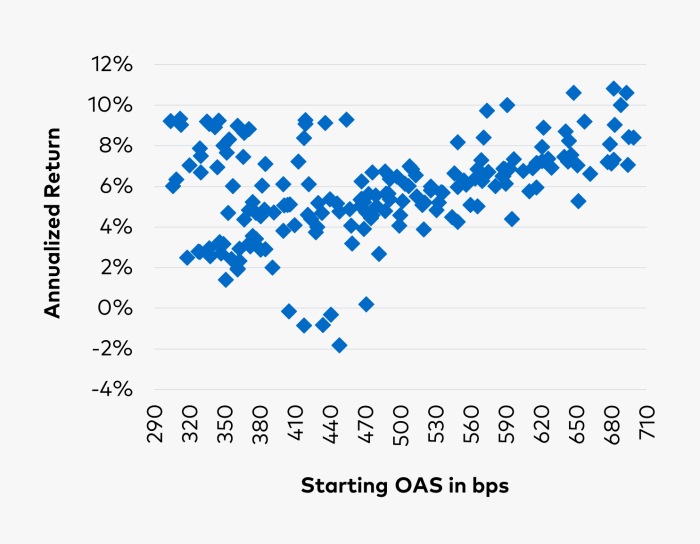

3. Longer investment horizons improve the distribution of returns

We observe that, on average, extending the holding period for an investment in the high yield market has historically improved outcomes. This result is especially true for periods in which starting option-adjusted spreads (OAS) ranged between 300 and 700 bps, which is the range we define as “normal” market conditions. Exhibit 3 shows the performance of the high yield market using month-end return data over a three- and five-year holding period during normal spread environments dating back to 1998. The lack of any real pattern in the data suggests that starting spread levels alone have not been a strong predictor of future performance. We believe that extending one’s holding period increases the likelihood of a good result for investors, as it allows them to extract the benefit of the coupon income, while minimizing the effect from short-term price fluctuations.

Exhibit 3A: Annualized Returns for Starting OAS between 300 and 700 bps, 1998 to 2023 (3 Year Holding Period)

Exhibit 3B: Annualized Returns for Starting OAS between 300 and 700 bps, 1998 to 2023 (5 Year Holding Period)

Source: Bloomberg as of December 31, 2023

Investor Key Takeaways

We have found that spread levels in and of themselves are not a strong predictor of future performance. Accordingly, we believe that maintaining a strategic allocation to high yield over the long term mitigates the effects of any short-term dislocations in bond prices, while also allowing a portfolio to compound over time the coupon income received. For these reasons, we believe that investors should maintain a strategic allocation to high yield as a component of a well-diversified portfolio.

Important Disclosures

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of March 2024 and may involve a number of assumptions and estimates that are not guaranteed and are subject to change without notice or update.

Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness, or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients.

This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.

The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The S&P 500® Index is a market capitalization weighted index that measures 500 common equities that are generally representative of the U.S. stock market. The index is maintained by S&P Dow Jones Indices. The Bloomberg U.S. Aggregate Bond Index is a broad-based, market capitalization weighted benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. Please note that one cannot invest in an index.

Correlation is a statistical measure that determines how assets move in relation to each other. It is measured on a scale of -1 to +1 and can be used to understand the amount of diversification among the assets contained in a portfolio.

Volatility measures the dispersion of market prices on an annualized basis. It is calculated by multiplying the standard deviation by the square root of the number of periods of time.

The Modified Sharpe Ratio is used to calculate the risk-adjusted performance of an asset or strategy. It is calculated by dividing excess returns by the modified value at risk.